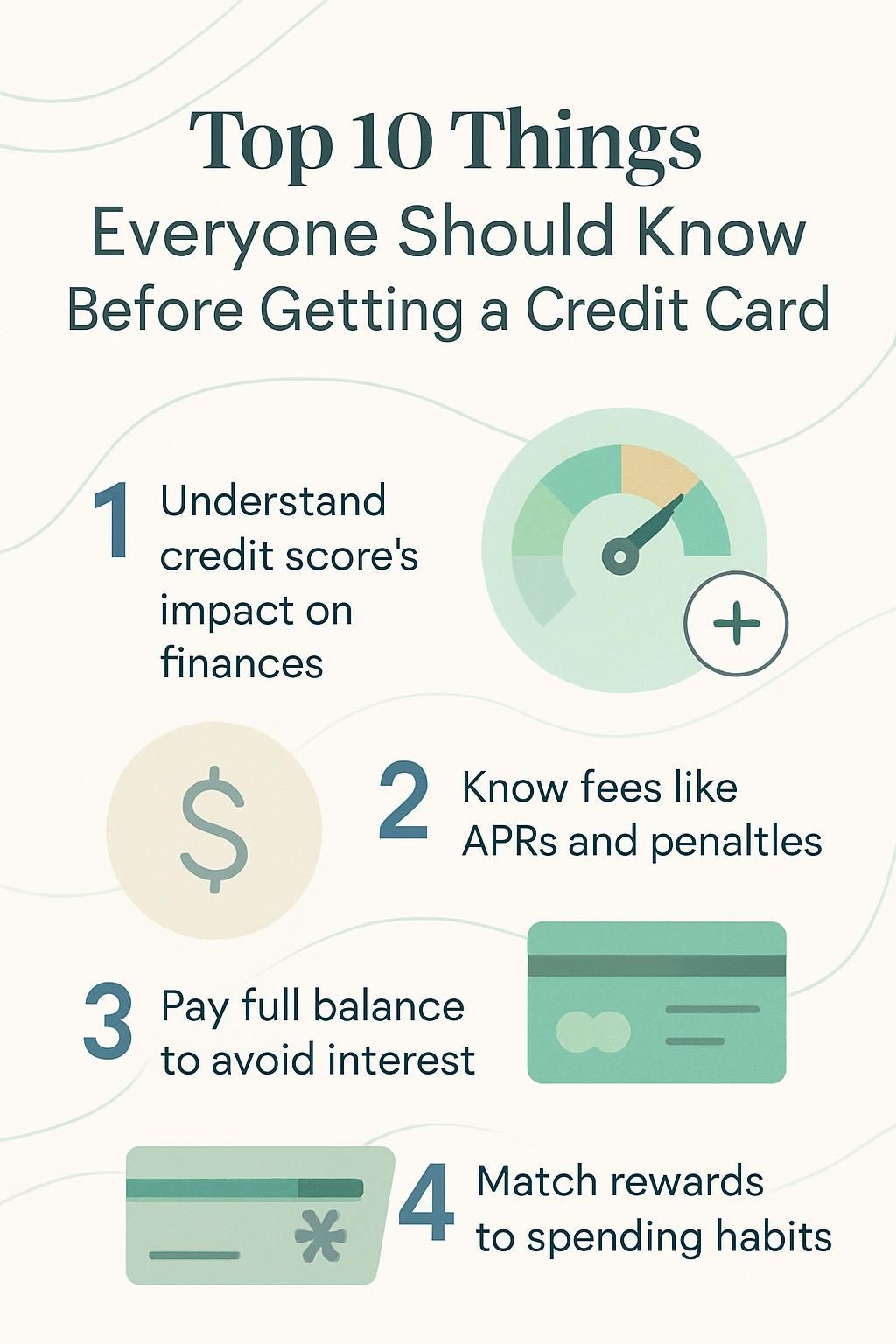

Top 10 Things Everyone Should Know Before Getting a Credit Card

Getting your first credit card can be exciting, but many people worry about making a costly mistake. About 42% of Americans carry credit card debt, often because they did not know some basic facts at the start.

This guide cuts through the confusion and shows you clear steps to protect your money and improve your credit score. Find out what you should always check before applying for a new card.

Key Takeaways

- Understanding your credit score and how it affects future financial opportunities is key before applying for a credit card. Good credit opens doors to lower interest rates, higher limits, and premium rewards.

- Familiarize yourself with the various fees associated with owning a credit card, including annual fees, APRs for different types of transactions, late payment penalties, cash advance fees, and foreign transaction charges.

- The impact of paying your full balance on time cannot be overstated; it avoids interest charges and late fees while contributing positively to your credit score. Keeping balances low relative to your limit also enhances credit scores.

- Credit cards offer robust fraud protection features that are not directly tied to bank account funds. Features include 24/7 transaction monitoring, the ability to freeze accounts if fraud is suspected, zero liability policies for unauthorized purchases, and the usage of advanced technology like chip-and-PIN or tokenization.

- When selecting a credit card, consider matching rewards programs to your spending habits for maximum benefit. Evaluate all terms including fees and APRs carefully against personal financial goals and habits—the right choice can offer significant returns through travel perks or cash back while minimizing costs.

Why is credit important?

Credit shapes your financial life and affects big decisions. Lenders check your credit report before offering a line of credit, a car loan, or even approval for luxury apartments. A strong credit history often brings lower interest rates and higher limits on new cards like American Express or Capital One.

A solid credit score also helps you qualify for better rewards cards and perks such as travel benefits or cash back. Good standing with the major credit bureaus lets you access premium services including online banking upgrades, concierge programs, and exclusive loyalty offers.

Good credit is an asset that opens doors to opportunities money alone can’t buy.

Key factors to consider before getting a credit card

Check every detail in the Schumer box to know your annual fee, interest rates, and grace period. Study how rewards programs or loyalty offers from different financial institutions fit with your usual spending categories before picking a card.

How can your first credit card affect your credit score?

Opening your first credit card starts your credit history, which the three major credit bureaus track. If you pay your full balance by the due date each month, your credit report reflects positive payment habits and builds a strong score over time.

Late payments show up quickly and can drop your credit rating fast. Using less than 30% of your total available credit limit also supports a higher score because it shows that you manage debt responsibly.

Issuing banks notify financial institutions about new accounts, so even one secured credit card shows on all reports. Each application for a line of credit creates a hard inquiry; too many at once could lower scores slightly in the short term.

People with high incomes often start with higher limits or exclusive rewards cards, but using them wisely is key. I got my first premium card young and made only small charges every month; this simple step allowed me to qualify later for luxury travel rewards programs and low interest rates on car loans as my strong record grew visible to lenders across years of spending cycles.

What fees and interest charges should you watch out for?

Getting your first credit card marks a significant step in financial independence. It’s crucial to understand the various fees and interest charges that can affect your finances.

- Annual fees: Some credit cards charge a yearly fee simply for having the card. This is common with cards offering substantial rewards or benefits.

- APR (Annual Percentage Rate): The interest rate on a credit card is critical because it determines how much you’ll pay if you don’t clear your balance each month. Cards might have different APRs for purchases, cash advances, and balance transfers.

- Penalty APR: Making a late payment or violating other account terms can trigger a higher interest rate on your outstanding balance, significantly increasing the cost of any debt.

- Late fees: Credit card companies impose late fees if you fail to make at least the minimum payment by the due date. These can add up quickly and impact your credit score.

- Cash advance fees: If you use your credit card to withdraw cash, you’ll likely encounter cash advance fees plus immediately accruing interest at a high rate.

- Balance transfer fees: Transferring the balance from one card to another, usually to take advantage of lower interest rates, incurs this type of fee.

- Foreign transaction fees: Purchases made outside your home country could attract additional charges, typically a percentage of the amount spent in a foreign currency.

- Over-the-limit fees: Spending beyond your credit limit may result in charges, although not all financial institutions impose these fees.

- Transaction fees for specific services: Specific transactions like buying gift certificates or making contactless transactions might have additional costs attached.

10 Credit line increase fee: Some issuers charge if you request an increase in your credit limit; however, this practice varies among financial institutions.

Understanding these potential costs helps in managing finances more effectively and choosing the right credit card based on individual spending habits and financial goals.

Why is paying your full balance on time crucial?

Paying your full credit card balance on time helps you avoid costly interest charges and late fees. Most credit cards offer a grace period, which lets you skip interest payments if you pay the entire balance before the next billing cycle ends.

Late payments can trigger higher penalty APRs or even damage your credit score since payment history makes up 35% of your FICO Score calculation. Your credit report will reflect these missed deadlines, which can affect how financial institutions view future applications.

Keeping up with every monthly due date means you keep more of your money instead of wasting it on needless penalties or extra interest rates. Skipping partial payments also sends a warning to banks and may result in reduced lines of credit or limits on rewards programs.

As Warren Buffett once said,.

“Chains of habit are too light to be felt until they are too heavy to be broken.”

How does high credit utilization impact your credit score?

High credit utilization can quickly drag down your credit score, even if you pay on time. If you use more than 30% of your available credit limit, lenders may see you as a risk. For example, having $10,000 in total limits and carrying a $4,000 balance pushes usage over that safe threshold.

Credit bureaus like Experian and Equifax track how much of your limit you spend during each billing cycle.

I once ran up charges to earn rewards points but saw my credit score drop by nearly 40 points the next month because my utilization shot past 50%. Strive to keep card balances low relative to limits with every financial institution so ratings from all three major bureaus stay strong.

Keeping tabs on these numbers ties directly into understanding the difference between credit cards and debit cards.

What fraud protection features do credit cards offer?

Credit cards offer strong fraud protection benefits. Most financial institutions monitor your transactions 24/7 to detect suspicious activity. If someone makes an unauthorized purchase, the credit card company can freeze your account immediately and investigate the charges.

Under federal law, you are only responsible for up to $50 of fraudulent charges, but most issuers cover you fully with zero liability policies.

Many cards use chip and PIN technology as well as tokenization with Apple Pay or Google Pay to keep payment data safe from theft. You can set up real-time alerts via text or email each time a purchase occurs on your card, helping catch problems instantly.

After experiencing attempted credit card fraud personally, I found that my issuer reversed a fake charge fast and shipped me a new card overnight at no cost. Credit cards usually do not leave your bank balance exposed directly; unlike prepaid debit cards or ATM cash withdrawals, any losses stay limited while banks resolve disputes quickly.

Some accounts let you lock your card using mobile apps if it gets lost or stolen before anyone uses it for more credit-card fraud. Reporting issues through online banking speeds up resolution times even further as the support teams prioritize these urgent requests above routine questions about interest rates or loyalty programs.

What is the difference between credit cards and debit cards?

Credit cards let you borrow money from financial institutions up to a set credit limit, while debit cards directly draw funds from your checking account. Each time you use a credit card, the bank pays the merchant and adds the amount to your billing cycle.

You can rack up rewards such as miles or cash back with many top-tier credit cards, especially those aimed at high-spending individuals. Paying only the minimum payment on a revolving balance triggers higher interest rates or even penalty APRs if you miss due dates.

Debit cards do not impact your credit score because they lack reporting features for major bureaus like Experian or Equifax.

Debit card transactions come straight out of available funds; there is no option to build credit history or carry balances past closing dates. Protection against fraud differs between products as well.

Most premium-level credit cards offer stronger liability coverage in case of theft or unauthorized charges than typical debit options do under federal law (such as Regulation E). Issuers may also include travel benefits, purchase insurance, and foreign transaction fee waivers—valuable perks for global travelers and investors alike.

Debit purchases rarely trigger such benefits except maybe limited ATM reimbursements through select accounts offered by banks like Chase Private Client or Bank of America’s wealth management services.

How do you choose the right credit card?

Choosing the right credit card takes careful thought about your spending habits, interest rates, fees, and whether rewards like travel points or cash back fit your needs—see how you can pick a card that works for your lifestyle.

How can you match rewards to your spending habits?

Credit card rewards work best if you align them with your actual spending categories. For example, if you travel often for business or leisure, a credit card that offers flight miles or hotel points can provide prime value.

Someone who spends heavily on dining and entertainment might choose a card that gives extra cash back in those areas instead of focusing on groceries or gas. Each major bank and financial institution has its own system for tracking these spending habits, so review the details in the Schumer box before making a choice.

I use my primary travel rewards card whenever I book flights or luxury hotels since it gives double points in those categories but only base points for department store purchases. Matching your credit card to your lifestyle can maximize benefits and reduce wasted potential from unused perks or limited bonus categories.

Next, compare fees, APRs, and different card benefits to avoid unnecessary costs while boosting returns.

Why compare fees, APRs, and card benefits before choosing?

As you align rewards with your unique spending profile, it’s just as vital to weigh the various costs and perks associated with each card. Comparing annual fees, interest rates, and benefits may seem obvious, but even high-net-worth individuals can miss out on optimal value without a thorough review. Below is a table summarizing why careful comparison makes a difference.

| Aspect | Why It Matters | Relevant Entities & Examples | Personal Insight |

|---|---|---|---|

| Annual Fees | Some premium cards charge $550 or more each year. High fees can offset rewards if benefits go unused. | Amex Platinum, Chase Sapphire Reserve, Citi Prestige | Once, I ignored a $595 annual fee on a luxury card and rarely used the perks. Lesson: Pay for value you actually capture. |

| APR (Interest Rate) | Low APR matters if you ever carry a balance, even by accident. Rates can range from 15% to over 29% in 2024. | Variable APR, Prime Rate, Federal Reserve | Accidentally missing a payment, I was hit with 28% interest. Even affluent cardholders can be surprised by high rates. |

| Hidden Charges | Foreign transaction, late payment, and cash advance fees chip away at your returns without much notice. | Visa Infinite, Mastercard World Elite, transaction fees | Traveling abroad in 2023, I paid 3% per transaction on a card without international perks. Always scan the fine print. |

| Card Benefits | Luxury cards offer airport lounge access, hotel elite status, and travel credits. Some perks overlap, reducing total value when you carry multiple cards. | PPS Club, Priority Pass, Global Entry, TSA PreCheck | Owning two cards with identical lounge access was redundant. Consolidation gave me leaner, sharper perks. |

| Rewards Structure | Cash back, travel points, and exclusive experiences each suit different lifestyles. Matching these to your habits maximizes ROI. | Membership Rewards, Ultimate Rewards, World of Hyatt Points | Shifting from cash back to travel points in 2022 matched my increased travel, boosting my rewards redemption by 30%. |

Conclusion

Picking a credit card affects your financial life, so take your time before you apply. Know the interest rates, fees, and rewards to match your spending style. Pay full balances on time to boost your credit scores and avoid debt traps.

Smart choices now build strong credit history for future investments or loans. Make every credit card payment count for both growth and security.

FAQs

1. What should I consider before getting my first credit card?

Before obtaining your first credit card, it’s crucial to understand the terms associated with it such as annual percentage rates (APR), grace period, and credit limit. You should also be aware of potential fees like annual fees and foreign transaction fees.

2. How does a credit score factor into getting a credit card?

Your credit score is an essential aspect when financial institutions consider you for a credit card. It reflects your spending habits and payment history, which helps lenders assess your ability to repay debts on time.

3. Can late payments affect my APR or result in penalty rates?

Yes, late payments can lead to increased interest rates known as penalty APRs. Additionally, they can negatively impact your credit scores reported by the three major bureaus: Experian, Equifax, and TransUnion.

4. Are there any protections offered against fraud for those using a credit card?

Most cards offer some form of fraud protection to guard against unauthorized purchases if lost or stolen; this adds another layer of security beyond that provided by federal law.

5. What are some benefits that come with using a secured credit card?

Secured cards can help build or rebuild one’s credit history while offering similar perks as traditional unsecured cards such as travel rewards or cash back on certain spending categories.

6. Can balance transfers help me manage my existing debt better?

Balance transfers allow you to move high-interest debt onto a new card with lower interest rates during an introductory period; however, keep in mind that most companies charge fees for this service.

Next Post

Next Post