The Hidden Costs of Credit Cards (and How to Avoid Them)

Swiping your credit card feels easy, but surprise charges can drain your bank account before you know it. Many people lose money on hidden fees and high interest without even realizing it.

This blog will show you how these costs add up and share simple ways to avoid them by using smart payment strategies and basic debt management. Want to keep more of your money? Read on.

Key Takeaways

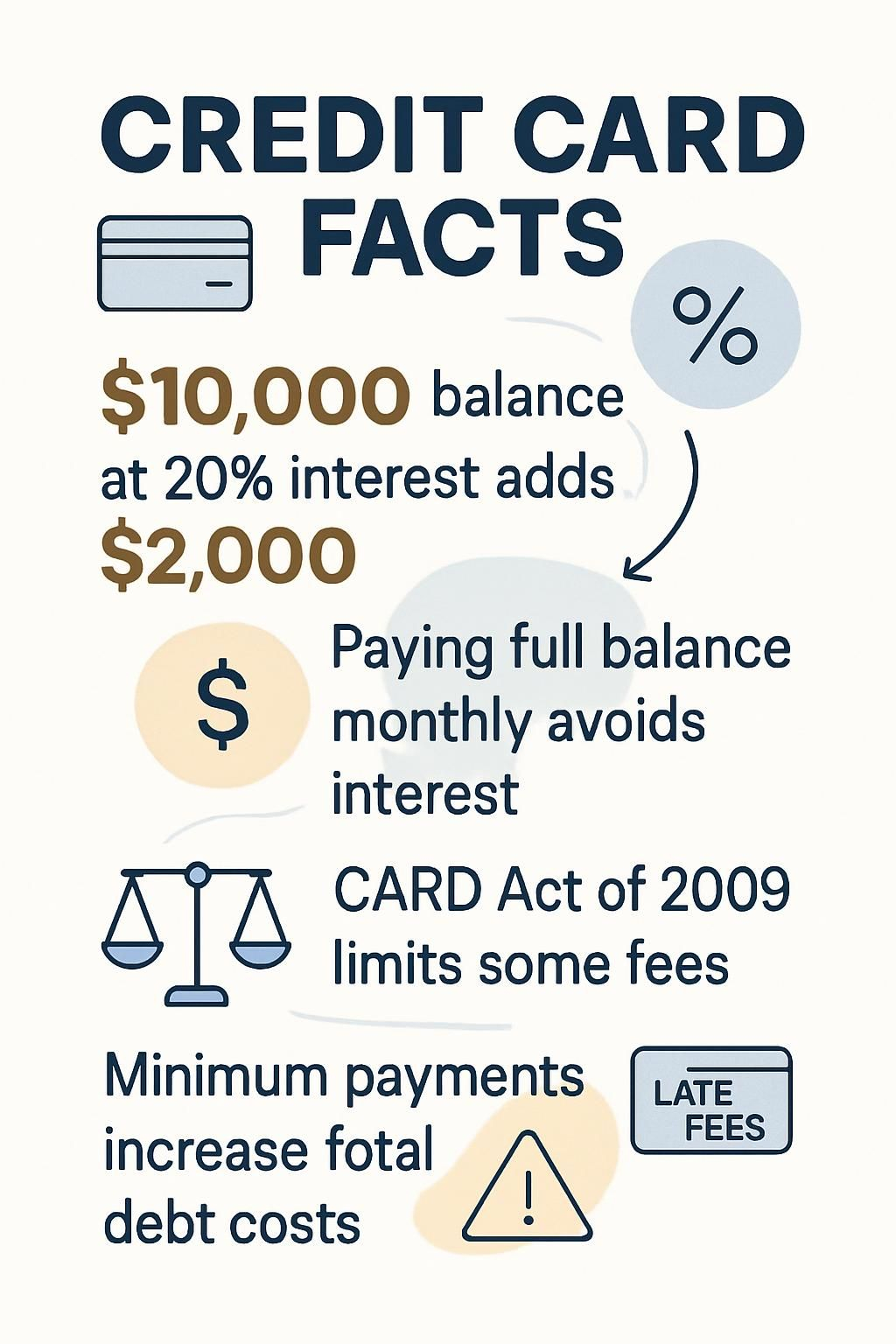

- Credit cards may encompass several hidden costs such as yearly charges, interest on retained balances, fees for balance transfers, cash advance fees, and costs for international transactions. Over time, these charges could mount up significantly, diminishing the advantages of the card. To illustrate, maintaining a $10,000 balance with an interest rate of 20% can lead to around $2,000 in extra charges annually.

- Implementing prudent financial tactics like employing credit cards with no annual fee, paying the total balance each month to sidestep interest costs, establishing automatic payments to circumvent late fees, and choosing cards that exclude charges for foreign transactions can aid in reducing or eradicating these covert costs.

- The CARD Act of 2009 has brought about regulatory modifications that safeguard consumers by limiting certain types of fees such as exceeding limit penalties. Nevertheless, it’s vital for individuals to proactively handle their accounts through routine monitoring and by making knowledgeable decisions in line with their expenditure patterns and financial objectives.

- Misapprehensions about credit card usage often result in expensive blunders; for instance, assuming that maintaining a balance enhances one’s credit score or downplaying the effects of only making minimum payments on total debt accumulation. Gaining knowledge about specific credit agreement terms and being conscious of how various transactions influence your total costs are vital moves for effective financial management.

- The decision of a suitable credit card type based on personal spending behavior and financial targets significantly aids in preventing unwanted costs. Cards made for international travel often forgive foreign transaction fees while providing extra benefits like travel insurance, which provides value during overseas trips or buying from international vendors.

What Are the Common Hidden Costs of Credit Cards?

Credit cards often carry extra charges that can surprise even wealthy users, such as hidden fees and unexpected interest costs. These financial traps can erode your wealth if you do not track statements and manage payments carefully with budgeting apps or personal finance tools.

What Are Annual Fees and How Do They Work?

Annual fees are yearly membership charges some banks make you pay for holding certain credit cards. These financial costs can range from as low as $50 to more than $500, depending on the type of card and its reward programs.

Cards with premium benefits like airport lounge access or luxury travel insurance often come with higher annual costs, while basic cards may not charge any at all. Some issuers, such as American Express and Chase, might waive the fee during your first year to attract new clients before billing it in following years.

Banks collect these charges whether or not you use your card that year. Cardholder expenses climb quickly if you don’t get enough value back from rewards or perks to offset what you pay in hidden fees.

Evaluate each offer by checking both the membership fee and benefits package; sometimes a no-annual-fee option saves thousands over time without cutting essential features. Choosing wisely helps avoid unnecessary financial losses connected with unused extras or high recurring payments.

How Do Interest Charges on Carried Balances Affect You?

Interest charges start to build up when you do not pay your full statement balance by the due date. These interest payments can pile up even if you only miss paying off a small portion.

For example, carrying a $10,000 credit card balance at an annual interest rate of 20% leads to nearly $2,000 in extra fees across a year. Instead of fueling debt, that same money could strengthen savings or boost investments.

High credit utilization from unpaid balances also hurts financial goals like home buying and retirement planning. As you pay just the minimum payment on your monthly statement, the loan repayment period grows longer and total costs rise sharply.

In my own experience as someone who once let a five-figure balance linger too long, I watched thousands go toward card companies instead of funding travel or portfolio growth. You protect your wealth best by treating full-balance payments as part of smart budgeting each month.

Interest is like a tax on impatience—over time it eats away at tomorrow’s opportunities.

What Are Balance Transfer Fees and When Do They Apply?

Balance transfer fees count as one of the most common hidden charges with credit cards. Banks charge these financial fees when you move your debt from one card to another, often during debt consolidation or loan transfers.

Most issuers set balance transfer costs at three to five percent of each amount transferred. For example, moving $10,000 could add $300 to $500 in instant charges before interest rates even come into play.

Many people overlook balance transfer fees while focusing on lower promotional interest offers from Visa or Mastercard providers. These payment processing costs apply right away and can quickly outweigh expected savings if you have a large credit utilization ratio.

Make sure to factor in every fee listed in the terms instead of just focusing on potential short-term benefits when transferring balances between accounts managed by Citi Bank, American Express, Capital One or Chase.

How Do Cash Advance Fees and Interest Rates Impact Your Costs?

Cash advance fees hit hard right away. Banks charge you each time you use a credit card for a cash withdrawal, often tacking on an extra fee of 3% to 5%. You also pay higher interest rates, sometimes above 25%, which start piling up from the moment you get the cash.

Unlike regular purchases, there’s no grace period; your debt starts growing instantly.

High interest and hefty fees can stall progress toward key financial goals like homeownership or boosting retirement savings. Paying only the minimum on this debt keeps the cycle going and increases total costs over time.

Using an ATM card or debit card avoids these pricey borrowing traps and lets more of your money work in investments or savings instead of paying off costly financial charges.

What Are Foreign Transaction Fees and How Can You Avoid Them?

Swiping your card abroad often triggers hidden charges called foreign transaction fees. Visa, Mastercard, and American Express usually charge about 1 to 3 percent of every global purchase.

That means a $10,000 luxury watch in Paris could add as much as $300 fast. Banks like Chase or Citi tack on these fees even if you buy online from an international retailer or book travel overseas in a different currency.

You can save money by picking credit cards with no foreign transaction fee for spending abroad. Premium cards such as the Chase Sapphire Reserve or the Platinum Card® from American Express let you avoid this added cost while giving strong exchange rates for global transactions.

Always check if your banking provider waives these extra costs before making large international purchases so more of your cash goes toward actual goods rather than hidden charges.

A luxury traveler once said, ‘The best memories come from journeys where you spend on experiences, not unnecessary banking fees.’

What Happens If You Make a Late Payment?

Foreign transaction fees can put a dent in your travel budget, but missing a payment brings even bigger headaches. Credit card companies charge late fees if you do not pay at least the minimum by the due date.

These penalties often start around $30 and increase with repeat offenses. If you make paying late a habit, issuers may slap you with penalty annual percentage rates that raise your interest costs far above standard rates.

Late payments also cause real damage to your credit report. Most banks notify Experian, Equifax, and TransUnion of overdue payments after 30 days; this can sharply drop your credit score and affect borrowing power for large purchases.

Higher utilization on cards makes future debt management tougher since high interest adds up fast on carried balances. Setting up automatic billing through tools like Chase Pay or Bank of America’s auto-pay helps keep accounts current so you avoid added financial penalties and protect creditworthiness.

From personal experience, one missed payment made my FICO score plunge nearly 60 points within weeks—an expensive lesson for anyone who enjoys seamless access to luxury lines of credit.

What Are Over-Limit Fees and How Can You Prevent Them?

Missing a payment can hurt your credit score, but exceeding your credit limit triggers over-limit fees and adds another layer of cost. Over-limit fees hit when spending passes the card’s set credit limit.

These extra charges are less common now due to major changes in United States credit card regulations like the CARD Act of 2009, but select issuers still include them.

To avoid these sneaky costs, keep an eye on account activity and use online banking apps or automatic alerts for spending limits. Choose cards that promise zero over-limit penalties whenever possible.

Always pay more than the minimum required balance to help lower total debt and reduce risk of passing your limit. Good financial management with tools such as budgeting software and account monitoring will ensure you stay well within your available credit line at all times.

What Are Returned Payment Fees and Their Consequences?

After discussing over-limit fees, let’s focus on another hidden charge: returned payment fees. Banks and credit card issuers hit your account with a returned payment fee if your method of payment does not clear.

This can happen if you try to pay your bill using a check or bank transfer but do not have enough funds in the linked account. These charges often sneak past even those who watch their statements closely.

Returned payment fees are part of many banks’ standard fee structure and usually range from $25 to $40 for each failed transaction. Some companies may also apply extra financial penalties and could raise your interest rates if missed payments become frequent.

Failing to keep enough money ready in your checking or savings account can cost more than just the direct fee; it might damage your credit score and lead to higher costs later on. Setting up automated reminders or monitoring accounts through banking apps like Chase Mobile helps prevent this drain on finances.

Even a single returned payment can result in stiff penalties that hurt both cash flow and creditworthiness.

What Are Some Common Myths About Credit Cards?

Many people think credit cards always lead to debt, but that is not true if you pay your balance in full every month. Some cardholders assume making only the minimum payment keeps their credit score high; in reality, it can hurt your financial health and pile on interest charges.

Others believe all rewards programs work the same or that annual fees mean poor value. If you choose a card with perks you use, even a fee can make sense.

A lot of users also expect fraud protection covers everything. Most banks offer strong safeguards, but quick action remains key after suspicious activity. It is common for new clients to underestimate how fast late fees and interest rates increase costs if payments slip through the cracks.

These myths often stop wealthy individuals from using credit cards as effective finance tools instead of costly liabilities.

How Can You Avoid Hidden Credit Card Costs?

Smart payment strategies and good budgeting tools help you steer clear of extra credit card fees. You can protect your wallet by managing balances, watching due dates, and using alerts from online banking platforms.

Why Choose No-Annual-Fee Credit Cards?

No-annual-fee credit cards cut out upfront card ownership costs. These zerofee cards help you keep more of your money, especially if you make only a few purchases each month. Many top banks such as Chase and Citi offer reward programs on no-annual-fee options, so even infrequent spending can earn points or cashback without extra charges.

Choosing budgetfriendly cards lets you access a line of credit with fewer hidden fees and gives flexibility in how you manage your finances.

People who want to save or test out different cards find value here since there is no pressure from yearly fees eating into their rewards. Most no-annual-fee accounts come with competitive interest rates and consumer savings perks that fit many lifestyles, not just those looking for basic features.

These options work well if you travel sometimes or use your card only for convenience rather than big purchases every month.

How Does Paying Your Balance in Full Each Month Help?

Choosing cards without annual fees is a smart move, but paying your statement balance in full each month delivers even greater rewards. By clearing the entire amount by your due date, you avoid interest charges that often stretch into hundreds or thousands of dollars each year.

Interest avoidance keeps more cash available for investments, savings strategies, or big purchases such as real estate.

Maintaining this habit shows financial responsibility and strengthens your credit score through responsible credit management. On-time payments prevent late fees and lower debt risk while also supporting goals like early mortgage payoff or expanding your investment portfolio.

Consistently paying off balances reduces debt and enhances long-term financial health for anyone focused on wealth protection and growth.

How Can Setting Up Automatic Payments Protect You?

Automated billing keeps your minimum payments on schedule, which prevents late fees and shields you from higher penalty APRs. Setting up automatic payments with tools like Chase’s AutoPay or American Express’s recurring payment feature makes forgetting due dates a thing of the past.

Timely payments strengthen your credit score and support responsible credit management. Maintaining regular payment cycles also helps keep your credit utilization low, reducing the chance of over-limit fees.

Payment reminders from mobile banking apps can reinforce solid financial planning by supporting effective budgeting and debt management. Banks such as Citi or Capital One offer features that allow you to choose full balance or minimum payment scheduling based on your cash flow needs.

This simple step encourages discipline while freeing you from unnecessary stress about missed deadlines or returned payment fees. Next, explore how avoiding cash advances and costly balance transfers further reduces hidden charges on high-limit accounts.

Why Should You Avoid Cash Advances and Balance Transfers?

Setting up automatic payments can help you avoid late fees, but it does not protect you from all types of credit card charges. Cash advances and balance transfers often bring hidden costs that quickly add to your debt.

Lenders charge a cash advance fee every time you use your credit card at an ATM or to get physical cash, with most banks setting this around 3% to 5% of the transaction amount. On top of that, interest rates on cash advances are much higher than regular purchases and start accruing immediately—no grace period applies.

Balance transfers also involve significant fees, usually about 3% to 5% per transfer. Even though moving debt between cards seems like a smart way to manage money, these extra costs can reduce any short-term benefits from lower teaser rates.

Large fees plus high ongoing interest easily push total debt higher without careful financial management. Using credit cards for direct withdrawals instead of debit cards leads to faster debt accumulation and increases total borrowing costs.

Smart payment strategies focus on minimizing fees and keeping your credit utilization low rather than shifting balances or taking out expensive advances through consumer finance companies or traditional banks such as Citi or Bank of America.

What Cards Are Best for International Transactions?

Select credit cards that waive foreign transaction fees for international purchases. This one detail can save you up to 3 percent per transaction, which adds up fast during global travel.

Choose cards with no annual fee to avoid paying extra just for owning the card. Compare options from major issuers like Chase Sapphire Preferred or Capital One Venture, as these are known for strong travel rewards and competitive exchange rates.

A good travel rewards card delivers bonus points or miles on airlines and hotels while offering airport lounge access and purchase protection benefits. Cards such as American Express Platinum provide excellent perks, though they may have a higher yearly cost.

No foreign transaction fees paired with built-in travel insurance bring peace of mind during trips abroad. Always review current card offerings so you secure the best rates and terms before making any international purchases; your wallet will thank you later.

Conclusion

Credit cards offer convenience and rewards, but hidden fees can quietly drain your wealth if you are not careful. Understanding costs like interest charges, annual fees, and late payments gives you more control over your personal finances.

Use smart payment strategies such as paying off your full balance each month or setting up automatic bill pay to protect both your bank account and credit score. Paying attention to these details ensures that credit cards support rather than hinder financial growth.

Smart habits help you keep more of what you earn for investments and future goals while lowering unnecessary expenses.

To dispel more myths and improve your credit card literacy, read our article on 5 common myths about credit cards you should stop believing.

FAQs

1. What are the hidden costs of credit cards?

Hidden costs of credit cards refer to charges and fees that aren’t openly advertised or communicated, such as annual fees, cash advance fees, balance transfer fees, foreign transaction fees, and late payment penalties.

2. How can I avoid these hidden costs?

To avoid hidden costs on your credit card, it’s essential to understand your card’s terms and conditions fully. Pay attention to fee structures for various transactions; always pay bills promptly to circumvent late payment penalties; refrain from using cash advances unless absolutely necessary due to high interest rates; and consider a card without foreign transaction fees if you travel frequently.

3. Are there any other unexpected expenses associated with credit cards?

Yes! Interest charges can add up quickly if you carry a balance from month-to-month rather than paying off your bill in full each cycle. Additionally, some cards charge an increased APR (annual percentage rate) if you miss a certain number of payments.

4. Can understanding my card’s terms help me save money?

Absolutely! By understanding your card’s terms thoroughly, you’ll be better equipped to use the features beneficially while avoiding costly pitfalls like hidden charges or escalating interest rates.

Previous Post

Previous Post Next Post

Next Post