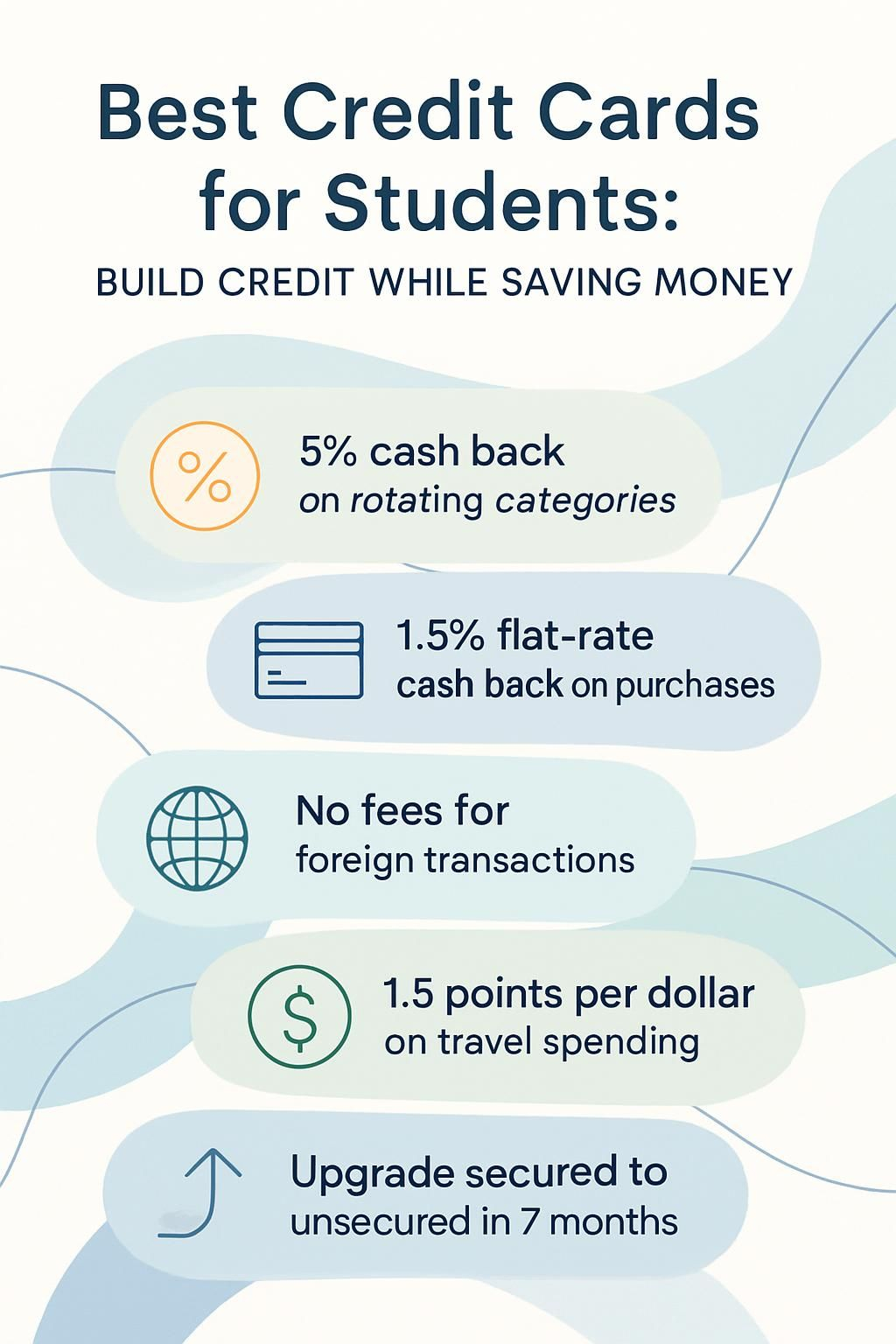

Best Credit Cards for Students: Build Credit While Saving Money

Getting your first credit card can feel confusing, especially if you want to start building credit and save money as a student. Studies show that using the right student credit card can help you build a positive credit history early.

In this post, I will explain how to pick the best options whether you care about cash back rewards, no annual fees, or growing your financial skills. Read on to start your own smart financial journey now.

Key Takeaways

- Discover it® Student Cash Back card offers five percent cash back in rotating categories and matches all cash back earned at the end of the first year, making it ideal for students seeking rewards on diverse spending habits without an annual fee.

- Capital One Quicksilver Student Cash Rewards provides a straightforward approach with 1.5% flat-rate cash back on all purchases, access to CreditWise for free credit monitoring, and no foreign transaction fees, catering to students favoring simplicity and predictability in their finances.

- Bank of America® Travel Rewards credit card allows student travelers to earn 1.5 points per dollar spent on all purchases with no blackout dates for travel redemption, plus a sign-up bonus after meeting initial spending requirements within three months.

- Chase Freedom Rise® targets individuals building credit from scratch by welcoming applicants with no previous credit history and providing tools to track FICO scores, emphasizing its utility for young adults or college students starting their financial path.

- Discover it® Secured Credit Card offers an upgrade path from secured to unsecured credit status based on consistent positive usage over seven months, highlighting the advantage of building a strong credit history while managing student budgets effectively.

Best Student Credit Cards to Consider in 2023

Finding the right credit card in college can help you start building your score early and save money each month. Some cards give cash back, rewards for spending in certain categories, and even options for people with little or no credit history.

https://www.youtube.com/watch?v=wYn5xBV9mGA

What makes Discover it® Student Cash Back great for rotating categories?

You earn five percent cash back on up to $1,500 in purchases each quarter in rotating bonus categories like Amazon.com, groceries, gas stations, and restaurants. Every three months brings new spending opportunities to maximize rewards without paying an annual fee.

The Discover it® Student Cash Back also matches all the cash back you earn automatically at the end of your first year.

Rotating categories keep earning interesting each quarter while building positive credit habits.

This program appeals to students who want flexibility as their expenses change throughout the year. Flat-rate cards appeal for simplicity—read on for why Capital One Quicksilver Student Cash Rewards fits that need.

Why choose Capital One Quicksilver Student Cash Rewards for flat-rate cash back?

While rotating categories can boost rewards in some spending areas, many students value simplicity and predictability in their cash back programs. Capital One Quicksilver Student Cash Rewards offers a clear way to earn on every purchase: it provides an unlimited 1.5% flat-rate cash back on all qualifying transactions, regardless of category or month.

This approach helps you manage your student finance with less effort since there’s no need to track changing bonus categories as you would with cards like Discover it®.

The card charges no annual fee, so every dollar earned counts toward savings rather than covering card costs. Cardholders also benefit from access to the Capital One CreditWise tool for free credit score monitoring, which can help build good credit habits while maximizing rewards.

Plus, international students will appreciate that there are no foreign transaction fees, making study-abroad payments easier to control and budget. For new applicants building their financial literacy and seeking accessible credit options without complex rules, this is a strong choice among best credit cards for students aiming to save money and strengthen their credit history at the same time.

How does Bank of America® Travel Rewards benefit student travelers?

Student travelers can earn 1.5 points for every dollar they spend with the Bank of America® Travel Rewards credit card. These points work well for booking flights, covering hotels, or paying off other travel expenses without any blackout dates to limit choices.

The card charges no annual fee and skips foreign transaction fees, which helps students save money during trips abroad.

Users get a sign-up bonus after meeting a simple spending requirement in the first three months. With flexible redemption options, students can apply their rewards directly towards recent travel purchases using their online account or mobile app.

The card supports good financial habits by reporting activity to major credit bureaus, helping students build solid credit histories through responsible use while exploring different places with more financial freedom.

Who should get Chase Freedom Rise® for no credit history?

People building credit for the first time benefit from Chase Freedom Rise®. This card targets those with no previous credit history, which includes many college students or young adults starting their financial journey.

The application process welcomes beginners and does not require established credit. With its cash back rewards and tools for tracking your FICO® score, it helps promote good money management right from the start.

I started out with zero credit myself; this card helped raise my score within six months by simply paying on time each month. “Smart choices early can mean a lifetime of strong credit.” For anyone considering approval requirements as they choose their first student credit card, knowing your own spending patterns comes next.

What are the advantages of Discover it® Secured Credit Card with upgrade options?

Discover it® Secured Credit Card offers a practical way for students or first-time credit users to start building their credit history. The card reports monthly to all three major bureaus, making each on-time payment help your score.

There is no annual fee, so you can focus on student finance and budgeting without extra costs eating into savings.

You deposit $200 or more as your security, but after consistent good credit habits for seven months, you may qualify for an upgrade to an unsecured line without closing the account.

This allows you to maintain your account age while enjoying higher limits and better cash rewards programs over time. Many find that this path makes accessible credit options less stressful while learning sound money management skills firsthand.

How do I choose the right student credit card?

Pick a student credit card that fits your money habits and supports good budgeting. Consider options with clear reward programs, low interest rates, and no annual fees for easier student finance management.

How should I consider my spending habits?

Track your spending by reviewing each transaction on your monthly statement. Use budgeting tools or mobile apps to see where most purchases happen, whether it’s travel, dining out, or online shopping.

Compare your usual expenses with any cash back rewards or points you could earn from student credit cards like the Discover it Student Cash Back or Capital One Quicksilver Student Cash Rewards.

Set a clear limit based on what fits your income and lifestyle. Make sure you never spend more than you can pay off in full every month; this practice helps build credit and avoids high-interest rates that quickly drain savings accounts.

Using these habits sharpens financial literacy and sets the groundwork for strong money management as a student.

Why look for low or no annual fees?

High annual fees can eat into your cash rewards and savings account growth, especially if you do not use many premium perks. Students often want accessible credit options that fit a student finance budget.

Choosing cards with no annual fee helps keep costs low, so every dollar earned in cash back or rewards stays in your pocket.

I have used a secured credit card during college that had zero yearly fees; my spending habits improved without worrying about extra charges. This allowed me to focus on building good credit habits and monitoring my credit score without paying for features I never used.

Over time, this approach supported strong money management and helped establish healthy financial responsibility early on.

What rewards and cash back offers should I check?

Focus on student credit cards that give cash back on your everyday spending. Many options, like the Discover it Student Cash Back card, offer 5% cash back in rotating categories such as groceries and gas each quarter up to a set limit after activation.

Flat-rate cards like the Capital One Quicksilver Student Cash Rewards card provide unlimited 1.5% cash back on all purchases, which works well for students who do not want to track categories.

Some student credit accounts also reward you with bonus offers or statement credits when you meet simple requirements in your first months. Check if a bank gives extra perks, such as travel points or discounts with popular merchants geared toward students.

Always compare how rewards line up with your personal habits; picking cards based on where you actually spend helps maximize gains and supports smart money management.

Cash back is like getting paid for purchases you already plan to make.

How do I ensure approval requirements fit my profile?

Start by checking your credit score using free tools that many banks or financial apps offer. Most student credit cards require limited or no credit history, making them accessible for first-time applicants who want to build credit.

Lenders may also look at your income, so having a part-time job or steady allowance can help you qualify. If you do not have a Social Security number yet, some issuers like Discover will allow international students to apply with just an Individual Taxpayer Identification Number (ITIN).

Banks usually prefer that you are enrolled at least half-time in college and over 18 years old. You should review each card’s specific approval criteria before applying. For example, secured cards often accept those with lower scores since they require a deposit as collateral, which reduces the lender’s risk.

Consider choosing a card without an annual fee and use budgeting skills to match their expectations for responsible money management. Matching these requirements increases your chances of approval while supporting healthy financial habits early in your journey.

How can I build credit with a student credit card?

Building credit with a student card starts when you use it to pay for everyday needs, manage your balance wisely, and watch your credit score grow—keep reading to see how simple steps can lead to financial freedom.

How do I spend responsibly and stay within my means?

Track your monthly expenses using a budgeting app or even a simple spreadsheet. Set clear limits based on what you can truly afford, not just the available credit line. Aim to use less than 30 percent of your credit limit, which signals smart money management to reporting agencies and helps your credit score.

Pay the full balance each month so you avoid interest charges that eat away at any rewards or cash back benefits. Use alerts from your banking app for payment reminders and fraud checks, keeping spending in check without stress.

Next, see why making payments on time is crucial for building good credit habits with student finance tools.

Why is making on-time payments crucial?

Making on-time payments has a massive impact on your credit score. Payment history makes up 35% of the FICO Score, according to Experian. Missing just one payment can drop your score by over 90 points and late fees often cost $25 or more each time.

Major lenders and banks like Discover and Capital One report every month to bureaus such as Equifax, TransUnion, and Experian. Every timely payment shows you are responsible with student finance.

Late payments hurt new credit histories worse than established ones. Early in my college years, I missed a due date on my secured credit card from Bank of America; my APR jumped from 17% to nearly 30%.

“One missed bill can stick around for seven years,” says John Ulzheimer, a recognized expert in credit education. To build good habits fast, set up autopay or calendar reminders so you never risk forgetting again.

Paying attention to these details helps you keep building strong financial literacy skills for better money management; now consider how regularly checking your credit score fits into this process.

How can I monitor my credit score regularly?

Check your credit score using free online tools like Credit Karma, Experian, or many banking apps. These platforms update your score once a week and let you see any changes quickly.

Monitor activity on your accounts to catch any errors or signs of identity theft early. Review detailed reports from the three main bureaus: TransUnion, Equifax, and Experian at least once a year through AnnualCreditReport.com.

Set up mobile alerts so you get notified if something shifts in your file, such as a new loan inquiry or missed payment report. Use budgeting apps that track both spending habits and credit score updates for more control over student finance decisions.

Keeping an eye on these numbers helps you build good credit habits while working toward stronger financial literacy without extra effort.

What should I know about my card’s APR and fees?

Your card’s Annual Percentage Rate (APR) shows how much interest you pay if you carry a balance month to month. Student credit cards often charge higher APRs than standard cards.

For example, some student cards might set rates between 19 percent and 28 percent, which can lead to fast-growing debt for unpaid balances. Late payment fees or cash advance fees can quickly add up as well, so reading the fine print matters.

Fees like annual charges or foreign transaction costs also affect your expenses and savings potential. Many top picks in 2023 offer no annual fee, making them smart choices for student finance planning and better money management.

I once had a card with twenty-three percent APR in college; paying even one bill late cost me over fifty dollars that month due to penalties and added interest. Watching both the rates and extra costs helps keep your financial journey smoother while building strong credit habits.

What common mistakes should I avoid with student credit cards?

Many students rush into credit card spending without understanding how it can hurt their budget and credit score. Learning smart money management with student finance tools helps you avoid simple slip-ups that slow your journey to good financial habits.

Why is overspending and carrying a balance harmful?

Credit card overspending often leads to carrying a balance, which triggers high interest rates averaging around 21 percent in 2023. Even students with significant resources see costs add up quickly if they let charges roll over month-to-month.

This can damage your credit score and make future borrowing more expensive or difficult. Interest payments eat into your savings and prevent you from using money for student loans, investments, or other financial opportunities.

A low balance keeps your options wide open—high debt shuts them down.

Missed payments and rising balances reflect poorly on your credit history. Lenders notice these habits when assessing applications for cars or homes later on. Responsible money management like paying the full amount each month builds good credit habits that support every step of your financial journey.

What happens if I miss payment deadlines?

Overspending and carrying a balance can hurt your financial journey, but missing payment deadlines takes things further. Late payments often trigger extra fees right away. Card issuers usually charge about $30 for the first late fee, though this amount can increase if you miss more than once within six billing cycles.

Your card statement will show these charges clearly.

If you pay late by over 30 days, most banks report it to credit bureaus like Experian or TransUnion. This negative mark lowers your credit score and makes future loans or luxury purchases tougher to secure on good terms.

Interest rates also rise after a missed deadline; penalty APRs often jump as high as 29 percent, so debt grows faster with each cycle. Setting up automatic payments with online banking tools keeps you on track and protects your student finance goals from setbacks caused by delays or penalties.

Why avoid applying for multiple cards at once?

Missing payment deadlines can hurt your credit score and make borrowing more expensive in the future. Applying for several cards at once can also harm your credit profile because each application triggers a hard inquiry, which may lower your score temporarily.

Lenders might view multiple recent applications as risky behavior since it looks like you need urgent access to money.

Focusing on one or two accessible credit options helps you build a strong financial history without raising concerns among banks or card issuers. Too many open accounts also make managing payments harder, increasing the chance of late fees and higher interest rates.

Taking it slow supports healthy money management habits and improves your long-term student finance outlook.

FAQs About Student Credit Cards

Have questions about student credit cards, credit scores, or building financial literacy on your money management journey? Read more to find simple answers that can help you make smart decisions.

Do I need a job to qualify for a student credit card?

Banks do not require every student to have a job before applying for a credit card, but they usually ask about income. Lenders accept different sources such as parent support, scholarships, grants, or even savings accounts.

If you are under 21 years old and lack independent earnings, most issuers will want an adult co-signer or proof of steady assets.

Some cards like the Chase Freedom Rise® or secured options from Discover let students qualify using their financial aid or scholarship money as income. Review credit building requirements carefully and consider accessible credit options that fit your situation.

Next up: steps to take if you receive a denial on your application.

What should I do if I’m denied a student credit card?

If you get denied a student credit card, check your rejection letter for the specific reason. Federal law requires credit card issuers to tell you why they declined your application.

You might see reasons like insufficient income, limited credit history, or issues in your credit report. Start by getting a free copy of your credit report from annualcreditreport.com and review it for errors that could impact your score.

Dispute any mistakes right away with the reporting agency.

Consider opening a secured credit card if you lack enough history or have no previous accounts. A secured card is easier to obtain because it uses a cash deposit as collateral while helping you build good habits.

Set up automatic payments and keep usage under 30 percent of your available limit to strengthen financial responsibility over time. Some banks let students use proof of savings account balances or scholarships as alternative forms of income on applications too.

Once you’ve built some positive payment activity on an easy-access product, try applying again after six months to one year based on improved scores and consistent money management experience.

Now think about what international students can do if they want their first line of accessible credit in the US market.

Can international students apply for credit cards?

International students can apply for credit cards in the United States, but banks usually set extra requirements. Most lenders ask for a Social Security Number (SSN) or ITIN to process the application.

Without a local credit history, international students often start with secured credit cards such as the Discover it® Secured Credit Card. This type of card uses a cash deposit as collateral and helps build a U.S. credit score.

Some companies like Deserve EDU offer unsecured student finance options for those without SSNs or established credit histories. As an international student, I found that bringing proof of enrollment, passport details, and visa information sped up my approval process at larger banks like Wells Fargo and Bank of America.

While limits might be lower at first, responsible use allows quick jumps in both spending power and personal financial literacy.

Conclusion

Choosing the best credit card as a student can start your financial journey strong. The right card lets you build credit, earn cash rewards, and practice money management. Focus on cards with low or no annual fees, smart interest rates, and easy approval requirements.

Make each payment on time to grow a positive credit history while enjoying valuable perks that fit your budget and lifestyle. Responsible use today leads to more options for saving and investing tomorrow.

FAQs

1. What makes a credit card best for students looking to build credit and save money?

A credit card is considered best for students when it has low or no annual fees, offers cash back or rewards on purchases, reports to all three major credit bureaus to help build credit history, and provides tools to manage spending and track progress in building credit.

2. How can a student choose the right credit card for their needs?

Students should consider factors such as interest rates, reward programs like cash back on groceries or gas, whether there are foreign transaction fees if they plan to study abroad, and how well the card issuer helps them monitor their spending habits.

3. Can having a student credit card actually help save money?

Yes! A well-chosen student credit card can offer benefits that lead to savings; these might include cash back rewards on everyday purchases like dining out or buying textbooks, introductory 0% APR periods which could reduce cost of borrowing, and absence of annual fees.

4. Are there risks involved with using a student’s first-time Credit Card?

While owning a Credit Card comes with benefits,it also carries risks if not used responsibly; high-interest rates can accrue if balances aren’t paid off each month leading to debt accumulation,and late payments may negatively impact one’s budding Credit Score.

Previous Post

Previous Post Next Post

Next Post