How to Spot and Avoid Credit Card Fraud

Many people worry about credit card fraud and identity theft, especially after hearing about data breaches. Each year, thieves steal millions through fraudulent transactions and account takeover scams.

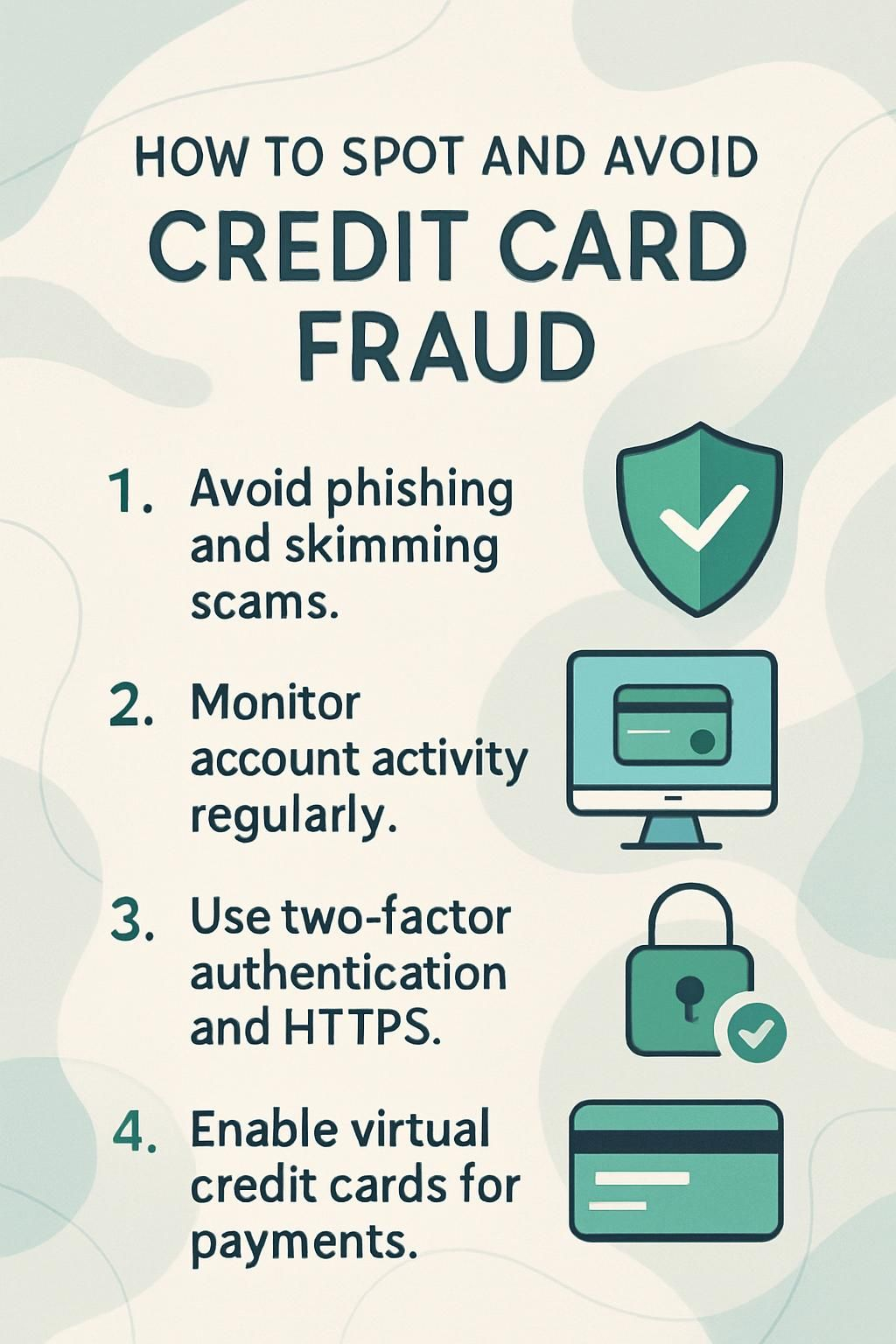

This guide will show you how to spot suspicious activity on your accounts and avoid falling for phishing scams or skimming devices at gas pumps or point-of-sale terminals. Find out the simple steps to secure your financial information.

Key Takeaways

- Common methods criminals use to access your financial data include phishing scams and skimming devices. These criminals often pose as trusted entities to grab your personal information. By being vigilant and confirming the legitimacy of requests for sensitive information, you can safeguard yourself from these scams.

- Essential strategies for swiftly identifying unauthorized transactions involve regular monitoring of account activity and the use of digital banking tools. Early detection of discrepancies is possible by setting up account alerts and thoroughly evaluating monthly statements. It also allows for prompt action against any possible fraud.

- Adopting stringent security measures, including the use of secure websites (https), enabling two-factor authentication, selecting complex passwords, and abstaining from public Wi-Fi for financial transactions all contribute to fortifying protection against credit card fraud. Moreover, choosing payment methods that provide fraud protection can boost the security of your financial information.

- Virtual credit cards add another level of security during online payments by creating a unique number for each transaction or merchant. It keeps your primary card details hidden, preventing potential theft. Setting spending limits and expiration dates on these virtual numbers offers a proactive defense against fraudulent activities.

- Knowledge about the most recent tactics utilized by cybercriminals can equip you to steer clear of scams. By getting fraud alerts from your financial institutions and learning about the newest phishing scam methods, you can maintain a step ahead of threats.

Common Methods of Credit Card Fraud

Criminals target your financial information using tricks like phishing scams and credit card skimmers. They also create fake websites or apps that steal your personal information and payment details during online shopping or mobile banking.

What are phishing scams and how do they work?

Phishing scams use fake emails, texts, or phone calls to steal your personal information. Scammers pretend to be financial institutions, credit card issuers, or even government agencies like the Federal Trade Commission.

They send messages that look official and urgent. These messages often ask you to verify details such as your credit card number, account password, or Social Security Number. Clicking a link in one of these messages can lead you to a counterfeit website that collects your data without your knowledge.

I once received an email claiming my debit card had been frozen for “suspicious activity.” The sender asked me to click a link and update my online banking login immediately. I noticed the web address was off by just one letter from my real bank’s site.

That small difference gave away their trickery. Many fraudsters also create pop-up windows on insecure websites or install malicious software through attachments in unsolicited emails.

Falling for these tricks can result in identity theft and unauthorized charges on your accounts before you realize what happened.

How do skimming devices steal credit card information?

Identity thieves use skimming devices to capture your financial information without you noticing. These small machines attach easily to ATMs, gas pumps, and even point-of-sale terminals at stores or restaurants.

Each time someone slides a credit card through the slot, the device records its magnetic stripe data. Thieves then collect this stolen data and clone it onto blank cards for unauthorized charges or account takeovers.

I once spotted a suspicious attachment at my local gas station’s pump. I compared it with another pump and noticed that one had a slightly loose card reader and an odd keypad overlay on top of the original buttons.

Experts from the U.S. Postal Inspection Service (USPIS) warn that criminals often hide pinhole cameras near keypads or install fake PIN pads to steal personal identification numbers alongside account details.

Every year millions fall victim to digital theft using simple but effective tools like card skimmers, says an FTC representative.

Staying alert can help prevent fraudulent transactions from draining your accounts faster than you think possible. Banks now deploy chip-and-PIN technology plus fraud detection systems for better protection against these attacks on credit cards and debit cards alike.

How can fake websites and apps trick you?

Fake websites and apps often copy the exact look of trusted financial institutions or stores. Logos, colors, and layouts match what you expect from your bank or favorite retailer. These criminal sites may ask for your personal information like credit card numbers, Social Security details, or logins under the pretense of a routine update or security check.

Criminals use phishing scams to lure people with urgent messages about suspicious activity or blocked accounts.

I have received emails that looked identical to those from my credit card issuer. Only after double-checking the web address did I spot small changes—sometimes just one letter off—from the real site’s URL.

Clicking through these fake portals can lead to identity theft and account takeover. Strong passwords and two-factor authentication offer strong fraud prevention against theft from these types of digital threats.

What are the warning signs of credit card fraud?

Sudden unauthorized charges often show up on your monthly statements and can indicate credit card scams or identity theft. Your bank or card issuer may flag suspicious activity, especially if thieves test your financial information with small purchases before going for larger amounts.

How to identify unfamiliar transactions on your statements?

Scan your monthly statements from your financial institution and search for transactions you do not recognize. Check the date, merchant name, location, and amount for each charge; fraudulent transactions often appear as small test charges or split purchases at places you rarely visit.

Use digital banking tools to match receipts with recorded purchases and watch out for repeated charges on the same day. Large withdrawals or sudden international payments can also signal credit card fraud or debit card fraud.

Set up account alerts through your bank’s app to catch suspicious activity as it happens. Digital wallets make tracking easier because they notify you about every payment attempt in real time.

If you notice any discrepancies, contact your card issuer quickly so they can investigate and help prevent further unauthorized charges. Next, see why unexpected declines or security alerts might show up while using your credit cards.

Why do unexpected declines or alerts happen?

After spotting unfamiliar transactions on your monthly statements, you may notice your bank declines a charge or sends an alert. Credit card issuers use advanced fraud detection tools to flag suspicious activity and block potential fraudulent transactions in real time.

For example, trying to make purchases in two cities at the same hour can trigger their systems because this looks like account takeover or digital wallet misuse.

Unexpected declines often occur if large amounts post suddenly or if an internet crime ring tests stolen data for validity. Financial institutions monitor financial information and personal information 24/7 with algorithms trained to catch online theft, man-in-the-middle threats, or credit card fraud schemes like phishing scams.

One time my own card got blocked after I purchased new electronics across state lines—my issuer thought it was a lost or stolen cards case before calling me.

Banks watch for patterns outside your normal spending routine as part of proactive fraud prevention.

Alerts give both you and the institution a chance to review any suspicious activity fast before it leads to bigger problems such as identity theft. Tools supporting these protections include strong passwords, chip and pin technology, and early notification from mobile wallets or secure websites—all helping keep unauthorized charges off your account.

How can I avoid credit card fraud?

Check your credit card statements often and watch for unfamiliar charges or suspicious activity. Use strong passwords and two-factor authentication on all your financial accounts, including digital wallets.

How often should I monitor my account activity?

Review your card statements at least once a week to spot fraudulent transactions fast. Daily monitoring using credit monitoring tools or digital wallet apps gives you even more control, especially if you have multiple accounts or bank with several financial institutions.

Credit reports from agencies like Experian, TransUnion, and Equifax help track unauthorized charges and identity theft.

I use my smartphone’s mobile banking app to scan for suspicious activity every few days. Text alerts from my card issuer warn me about large purchases or changes to account settings right away.

Frequent checks let you catch debit card fraud early before thieves cause serious damage to your finances.

How do I use secure websites and trusted payment methods?

Monitoring your account activity is critical, but of equal importance is understanding how to utilize safe websites and dependable payment techniques. This makes sure your financial information remains inaccessible to those with harmful intentions.

- Always verify the presence of ‘https’ in the website’s URL prior to providing any personal or financial details. Websites with ‘https’ encrypt data, making it challenging for thieves to intercept.

- Search for a lock icon in the web browser’s address bar. This symbol signifies that the site employs security precautions to safeguard your data.

- Opt for payment methods providing fraud protection, such as credit cards or e-wallets like PayPal. These services frequently offer a security layer by preventing your card information from being directly exposed to merchants.

- Enable two-factor authentication (2FA) for online accounts if made available. This introduces an extra step to confirm your identity, typically through a text message or email code, making unauthorized access harder.

- Select robust passwords for online accounts and refresh them periodically. Utilize a combination of letters, numbers, and symbols to create passwords that are more difficult to decipher.

- Be careful with public Wi-Fi networks while making online purchases or accessing financial accounts. Insecure networks can present opportunities for attackers to steal personal details.

- Keep your computer’s and smartphone’s operating systems and applications updated on a regular basis to protect against vulnerabilities that hackers could potentially misuse.

- Subscribe to fraud alerts from your financial institutions and credit bureaus. These alerts inform you about suspicious activities on your accounts or if someone tries to establish credit under your name.

- Ensure that you download applications only from official app stores such as Apple’s App Store or Google Play Store; these platforms scrutinize apps for security issues.

- Familiarize yourself with phishing scams and other fraudulent activities by studying current tactics employed by cybercriminals.

These strategies have proven beneficial in my personal encounters, providing tranquillity while conducting online transactions and defending against potential threats present on the internet. Through these methods, I’ve succeeded in maintaining the security of my financial data within an increasingly digitized landscape filled with potential risks at each turn.

How do fraud alerts and notifications protect me?

Fraud alerts and notifications act fast to help stop unauthorized charges. Your card issuer or credit monitoring service sends quick alerts for unusual activity like large withdrawals, purchases in unfamiliar places, or account changes.

These warnings allow you to react before thieves can cause big losses or commit identity theft with your personal information. Setting up fraud alerts helps spot and prevent fraudulent transactions early; most banks let you receive texts, emails, or app push notifications.

Credit bureaus such as Equifax offer the option to add a fraud alert on your credit report at no cost. This action makes lenders take extra steps to confirm your identity when they see requests on your file.

Using digital wallets that include real-time payment updates provides another layer of defense against financial crime and online theft. Next, discover how virtual card numbers add even more security during payments both online and off.

What role do virtual credit cards play in securing payments?

Virtual credit cards create a unique card number for every transaction or merchant. This keeps your real card details safe from phishing scams, online theft, and man in the middle attacks.

Many issuers, like American Express and Capital One, offer these options through their digital wallets or mobile apps. You can set spending limits and expiration dates on each virtual card to block fraudulent transactions before they start.

I use a virtual credit card for large online purchases and subscriptions after hearing about identity theft cases among people I know. Even if thieves get that temporary number from skimming devices or fake websites, my main account stays protected.

Managing these cards is simple; most financial institutions allow you to freeze them instantly if you spot suspicious activity or unauthorized charges on your statements. Virtual credit cards add an effective extra layer of fraud prevention without making shopping more difficult for wealthy users with multiple accounts.

Conclusion

Spotting and avoiding credit card fraud takes smart habits. Monitor your monthly statements and set up fraud alerts through your card issuer or digital wallet. Use strong passwords, enable two-factor authentication, and always check that you use secure websites with trusted payment methods.

Report suspicious activity quickly to financial institutions, contact the Federal Trade Commission (FTC), or local law enforcement if needed. Protecting your personal information goes a long way toward keeping your credit score strong and stopping identity theft in its tracks.

Discover more about safeguarding your transactions by exploring the future of secure payments with virtual credit cards.

FAQs

1. What is credit card fraud and how can I spot it?

Credit card fraud involves unauthorized charges made using your personal information, including identity theft or account takeover. Spotting it often includes noticing suspicious activity on your monthly statements, such as fraudulent transactions from places you have not visited.

2. How can I prevent debit and credit card fraud?

Prevention begins with safeguarding your financial information. Use strong passwords for digital wallets and online accounts, enable two-factor authentication where possible, and regularly check your credit report for any signs of identity theft.

3. What steps should I take if my cards are lost or stolen?

Immediately contact your card issuer to report the loss or theft. You may also want to place a fraud alert on your credit reports through the three major credit bureaus: Experian, TransUnion, and Equifax (myEquifax). This alerts potential lenders to verify identities before extending new lines of credit in your name.

4. Are there specific types of scams that lead to more cases of ID theft?

Yes! Phishing scams are common methods used by thieves who trick individuals into providing personally identifiable information (PII) via email or fake websites that resemble legitimate financial institutions’ sites. Also beware of skimming devices at gas pumps or ATMs which capture card details.

5. How do I recover from identity theft after falling victim to a scam?

Firstly, file a complaint with the Federal Trade Commission (FTC) through IdentityTheft.gov; this will help create an ID Theft Recovery Plan tailored specifically for you! Report the incident to local law enforcement too; they may provide additional resources!

6. Can monitoring services help protect me against future incidents of fraud?

Absolutely! Credit monitoring services keep tabs on changes in your score while Fraud detection systems flag unusual patterns like sudden increases in spending habits – both tools allow swift action if anything seems amiss.

Previous Post

Previous Post Next Post

Next Post