Prepaid vs. Secured Credit Cards: Which One Should You Choose?

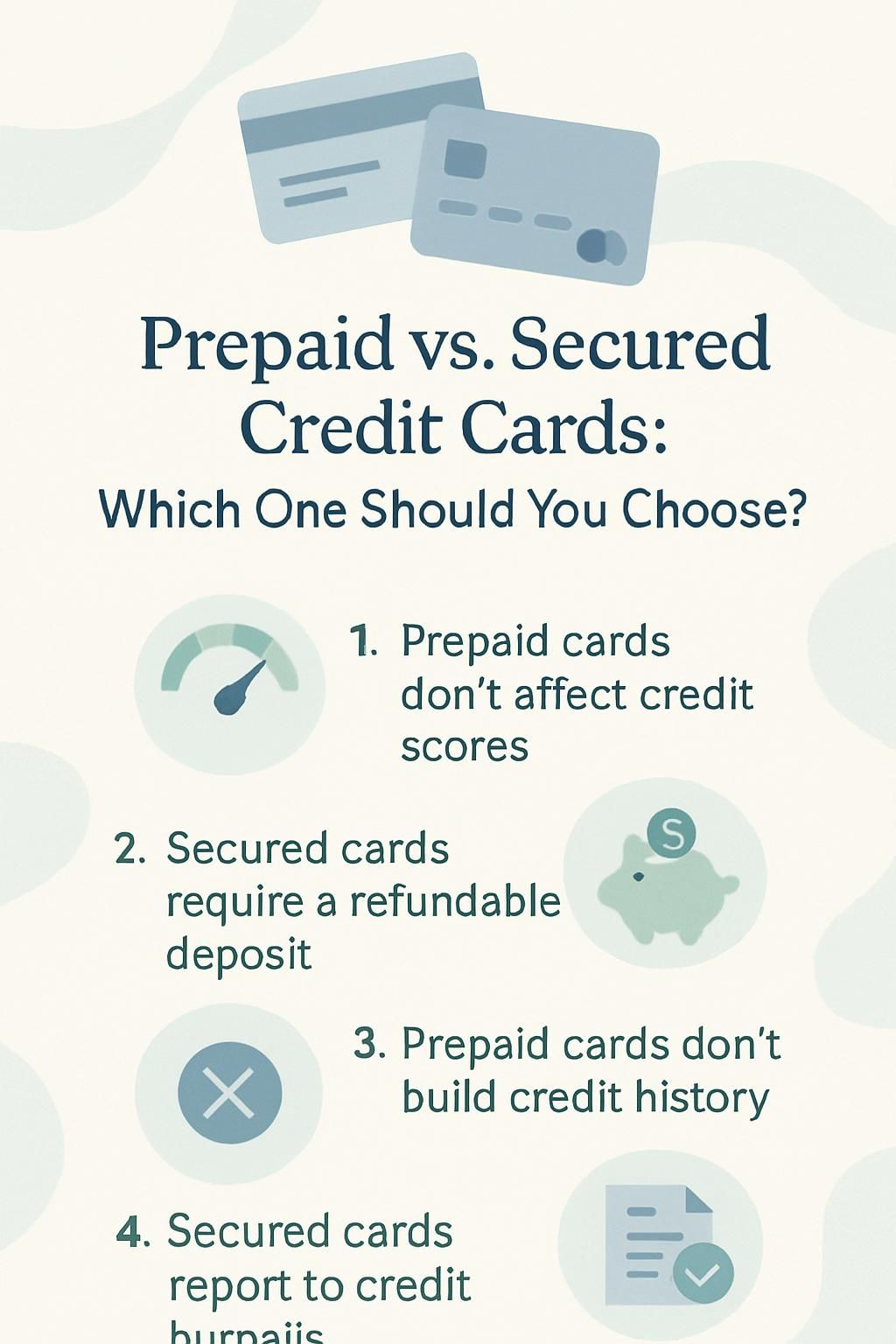

Choosing between a prepaid card and a secured credit card can feel confusing, especially if you want to build your credit history or manage money better. About 54 million Americans have little or no credit history, and picking the right payment card is key to reaching their financial goals.

This post compares the main benefits, uses, and drawbacks of both prepaid cards and secured credit cards to help you make a smart choice. Keep reading to see which option fits your lifestyle best!

Key Takeaways

- Prepaid cards provide immediate spending access without impacting your credit score, perfect for budgeting and preventing debt since you’re limited to the amount you put on the card. They don’t require a credit check, making them available to anyone, no matter their financial past.

- Secured credit cards need a refundable security deposit that defines your credit limit and help construct or mend your credit profile by consistently reporting to principal bureaus like Experian, Equifax, and TransUnion. Payments on these cards better your score gradually with responsible use.

- While prepaid cards don’t support in building a credit history due to the absence of reporting to consumer agencies, secured cards offer a route for improving one’s borrowing history through regular, prompt payments as seen with reported score increases from users’ experiences.

- The starting funding for both card types differs significantly: secured cards frequently start with $200 deposits that become the user’s limit, while prepaid cards merely require loading adequate funds for activation fees or purchases without a demand for a set minimum balance.

- Both card alternatives come with unique benefits suited to different financial ambitions: ensuring improved money management and avoiding overdrafts with prepaid choices versus reconstructing or creating a good credit standing through secured cards.

Key Differences Between Prepaid and Secured Credit Cards

Prepaid debit cards work like stored-value cards and do not impact your credit history. Secured credit cards, issued by banks, require a refundable security deposit and can help build your credit score through regular reporting to consumer agencies.

https://www.youtube.com/watch?v=-ts-5d8kQ3g

What Are the Main Uses of Prepaid vs. Secured Credit Cards?

People use prepaid debit cards for everyday purchases, managing spending, and giving as gifts. These reloadable cards function much like cash or a checking account without connecting to a line of credit.

Travelers often choose them for international trips due to fewer risks of unauthorized charges. Parents hand them out to teens for allowance and teaching money management without the fear of overdraft fees or debt accumulation.

Secured credit cards serve mainly for building credit history or repairing poor credit scores with consumer reporting agencies like Experian, Equifax, and TransUnion. You pay a refundable security deposit that becomes your credit limit; each on-time payment helps improve your borrowing history in your credit report.

Banks require monthly payments just like an unsecured credit card but usually charge higher annual percentage rates and more fees until you qualify for standard products. Next up: how these two types of payment cards impact your score with the major bureaus.

How Do Prepaid and Secured Cards Affect Your Credit?

Prepaid cards do not help build credit history because the card issuer does not report your activity to credit bureaus. No matter how often you reload or use a prepaid card, it will never show up on your credit report or improve your credit score.

These cards work like gift cards since you only spend what you load onto them and do not borrow any money from a bank account or credit line.

Secured credit cards offer an easy way to start building or rebuilding credit if you have none, poor payment history, or past bankruptcies. Your payments and usage on a secured card get reported monthly to all three major credit bureaus—TransUnion, Experian, and Equifax—which helps raise your score with responsible behavior.

I once used a secured card after college; my consistent on-time payments for six months caused my score to jump by 82 points according to Credit Karma’s data from fall 2023. To open one of these accounts, you provide a refundable security deposit that usually sets your starting limit but gives access to traditional card benefits such as cash advances and insurance while helping track responsible usage for future upgrades into unsecured products over time.

What Are the Funding Requirements for Each Card Type?

To open a secured credit card, you must make a refundable security deposit. Most issuers require at least $200 as your starting deposit, which becomes your credit limit. The credit card company holds this money while you use the card and repay monthly statements.

If you pay on time and demonstrate responsible credit usage, you may get upgraded to an unsecured credit card later, with your deposit returned.

For reloadable prepaid cards or prepaid debit cards, load money onto the account before use. There is no need for a bank check or minimum opening balance—just enough funds to cover activation fees or initial purchases.

No security deposit connects to building credit since these products do not report activity to any major bureau like Experian or Equifax. My own experience with both options revealed that funding a secured credit card involved more up-front planning because I had to tie up cash as collateral; by contrast, it was easy to add value instantly online or at stores for my prepaid option using only my paycheck.

Benefits of Secured Credit Cards

Secured credit cards can give you access to a line of credit when other options are out of reach. Many card providers, such as American Express or Discover, use your payment history on these accounts to report positive behavior to major credit bureaus.

https://www.youtube.com/watch?v=akEcgMXWfN8

How Do Secured Credit Cards Help Build or Rebuild Credit?

Lenders use secured credit cards as a tool for building credit history. You put down a refundable security deposit, which acts as your credit limit. Card issuers report your payment history to major credit bureaus such as Experian, Equifax, and TransUnion.

On-time payments show responsible credit usage and increase your chances of moving up to an unsecured credit card.

Reporting monthly activity lets you grow your borrowing history step-by-step. I once helped a friend who used her secured card strictly for recurring charges like Netflix or Spotify subscriptions.

After six months of paying the balance in full each cycle, her FICO score rose over 40 points. As quoted by CNBC:.

Consistently making on-time payments with a secured card can help improve your score within several months.

How Is the Credit Limit Determined on Secured Credit Cards?

Your credit limit on a secured credit card depends almost entirely on the amount you place as your refundable security deposit. Most banks and card issuers set your starting limit to match your deposit, usually between $200 and $5,000.

For example, if you provide a $1,000 deposit during account opening, the credit card issuer gives you a $1,000 spending limit. Some issuers allow higher limits for large deposits or offer automatic reviews after several months of responsible use.

Card providers may consider other factors such as payment history with existing accounts or recent personal loans when reviewing requests for an increased limit. A strong track record of on-time payments and responsible credit usage can lead to future unsecured offers without another deposit.

Your utilization rate remains important because it impacts your credit score reported to major bureaus like Experian or TransUnion each month. By maintaining low balances compared to your credit line and making monthly payments on time, you show financial discipline that helps strengthen your borrowing history in both secured and unsecured lending markets.

Do Secured Credit Cards Report to Credit Bureaus?

Secured credit cards do report your payment history and account activity to the major credit bureaus, including Equifax, Experian, and TransUnion. Lenders use this information to update your credit report each month.

Making on-time payments improves your credit score over time and helps build a healthy borrowing history.

My own secured card reports monthly data that tracks my responsible usage and increases my available credit limit after about six months of good standing. The security deposit you provide serves as collateral but does not affect how the issuer reports transactions or balances.

Most secured cards include these reporting features by default, making them powerful tools for building or rebuilding credit, unlike prepaid debit cards which offer no impact on your financial record with any bureau.

Benefits of Prepaid Cards

Prepaid cards give you fast access to spending without a credit check or risk of debt, and there are even reloadable options for easier money management—scroll down to find out how they might fit your needs.

Do You Need a Credit Check for Prepaid Cards?

No credit check is required for prepaid cards. Banks and card issuers do not review your credit history, credit score, or banking record before issuing a prepaid debit card. This allows you to avoid any impact on your credit report or concerns about existing borrowing history.

Anyone can purchase a reloadable prepaid card regardless of payment history or past money management habits. You only need to pay the activation fee and provide identification. As these cards are not tied to loans or monthly payments, neither the issuer nor any major credit bureaus collect data from your account activity.

A prepaid debit card offers access without judgment—no one checks your FICO score when you apply.

How Can Prepaid Cards Help with Budgeting?

Prepaid cards put you in direct control of your money management. You can only spend what you load onto the card, making it easy to avoid overdraft fees or piling up debt. Unlike unsecured credit cards that allow spending beyond your means and may charge high interest rates, prepaid debit cards stop purchases once your balance hits zero.

Many reloadable cards send real-time alerts about each transaction, so you always know where your funds stand.

Using a prepaid card helps track daily expenses for groceries, subscriptions, or travel without risking overspending. Some platforms offer budgeting tools built into their mobile apps; these break down spending categories and highlight unusual activity or excessive charges.

I have used a prepaid credit card while setting strict monthly budgets for vacation trips and found managing costs much simpler compared to using traditional charge cards. This approach supports financial discipline because every dollar spent is pre-committed upfront instead of billed later with potential late fees or interest charges on missed payments.

Prepaid cards also never require a credit check before activation, keeping the process straightforward no matter your borrowing history.

Can You Accumulate Debt with a Prepaid Card?

After seeing how prepaid cards can make budgeting easier, it’s smart to ask about the risk of debt. You cannot accumulate debt with a prepaid card because you only spend money you have already loaded onto the card.

The bank or card issuer does not extend credit or allow overdrafts, so your balance never dips below zero.

You avoid interest rates, late fees, and monthly payments tied to borrowing. If your reloadable prepaid debit card runs out of funds, transactions get declined instead of creating a negative balance like on traditional unsecured credit cards.

This structure helps prevent accidental overspending and keeps your finances in check without affecting your credit history or bolstering any payment history with credit bureaus.

Best Credit Cards for Online Shopping and Subscriptions

Cards like the Chase Sapphire Preferred and American Express Blue Cash Everyday make online shopping easy while offering strong cash back on digital purchases. The Chase Sapphire Preferred gives 2x points on online spending, and many users report fast credits for streaming subscriptions from platforms like Netflix or Spotify.

The American Express Blue Cash Everyday card provides 3% cash back at U.S. online retailers without a foreign transaction fee, which can help if you shop globally.

Prepaid cards such as the NetSpend Visa Prepaid Card skip credit checks but charge activation fees and monthly maintenance costs; these work well for setting strict budgets but do not build credit history.

Secured credit cards from Capital One offer better fraud protection than prepaid debit cards, set your credit limit based on your security deposit, and often include perks that help with responsible credit usage—important if you want to build or repair your borrowing history through regular, on-time payments.

A well-chosen secured card does more than buy things—it quietly helps grow your money story.

Which One Should You Choose?

Your financial goals matter most in this decision. Think about whether building credit or easy money management is your priority, since each card type supports a different approach.

When Should You Choose a Secured Credit Card?

A secured credit card fits best if you want to build or rebuild credit but have no recent borrowing history or a less-than-perfect credit score. Banks give these cards even if past payment history includes missed payments, a bankruptcy, or little data on your report.

You make a refundable security deposit with the card issuer, and that deposit usually becomes your starting credit limit. Lenders then track your monthly payments and report them straight to major credit bureaus—TransUnion, Equifax, and Experian—which means each on-time payment helps improve your credit profile.

Large purchases become easier because most retailers accept secured cards anywhere they take Visa or Mastercard; prepaid debit cards are often excluded from some online shopping sites and subscriptions.

Some issuers may upgrade qualifying customers to unsecured accounts after responsible usage for twelve months without late fees or overdraft protection claims. If growing purchasing power is your goal while building strong money-management habits for future personal loans or high-tier rewards programs, this option puts you in control of both spending and progress.

Now compare this approach with the situations where a prepaid card makes more sense.

When Is a Prepaid Card the Better Choice?

Travelers often choose prepaid cards for safety and simple money management. Loading a set amount onto the card keeps spending in check and prevents unwanted surprises like overdraft fees or accumulating debt.

These reloadable cards do not require a credit check, which can be helpful if you want anonymity or privacy from credit bureaus.

Prepaid debit cards offer straightforward ways to manage daily expenses without worrying about monthly payments or interest rates. In my own experience during long overseas trips, I found that prepaid cards made it easy to stick to a budget while avoiding high transaction fees from local banks.

You also avoid the risk of unauthorized charges impacting your main bank account since only loaded funds are at stake. For people who desire convenience, security, and control over their money without affecting their credit history or score, these cards deliver clear benefits.

Conclusion

Choosing between a prepaid card and a secured credit card depends on your financial priorities. If you aim to build or rebuild your credit score, a secured credit card is the smarter option since it reports to major credit bureaus like Experian and TransUnion.

Those who want easier money management or wish to avoid debt may find prepaid cards more suitable for everyday spending and online shopping. Both options help protect against unauthorized charges if used responsibly.

Assess your goals before picking the plastic that fits your lifestyle best.

For more information on optimizing your digital spending, explore our guide on the best credit cards for online shopping and subscriptions.

FAQs

1. What is the difference between prepaid cards and secured credit cards?

Prepaid cards, also known as reloadable cards or prepaid debit cards, allow you to load money onto them for use in transactions. They do not require a credit check and are good for money management but they don’t help build your credit history. On the other hand, secured credit cards are issued by a credit card issuer and require a refundable security deposit which often determines your credit limit. These can help build your borrowing history if used responsibly.

2. How can using these types of cards impact my credit score?

Secured credit cards can have a positive impact on your credit score if you make on-time payments since payment history is reported to the major three Credit Bureaus: Experian, TransUnion, and Equifax. Prepaid debit Cards do not affect one’s borrowing history because they aren’t reported to these bureaus.

3. Are there any fees associated with prepaid and secured credits?

Yes! Secured credits often carry annual fees while prepaid ones may come with activation fees, transaction fee or monthly maintenance fees depending upon the card provider’s policies.

4. Can I switch from a secured to an unsecured card?

Yes! Once you establish responsible usage over time through consistent on-time payments and maintaining low balance relative to your limit (credit utilization rate), many issuers will upgrade you from secured to unsecured status without requiring additional personal loans or deposits.

5.What protections are offered against unauthorized charges with these types of Cards?

Most providers offer protection against unauthorized charges but it varies across different products; always read terms carefully before signing up!

6.Do overdrafts occur with both type of Cards?

Overdrafts typically only apply when spending exceeds available funds in checking accounts linked to traditional bank-issued debit/credit products; however some Prepaid Card providers might allow this feature at extra cost.

Previous Post

Previous Post