How Do Credit Cards Actually Work? A Beginner’s Guide

Do credit cards confuse you with all their rules, fees, and fine print? Nearly 70% of Americans own at least one credit card, but many do not know how these cards actually work. This guide will show you what a credit card is, explain key terms like annual percentage rate and billing cycle, and offer simple tips for responsible use.

Find out how smart choices can help protect your money and build your credit history.

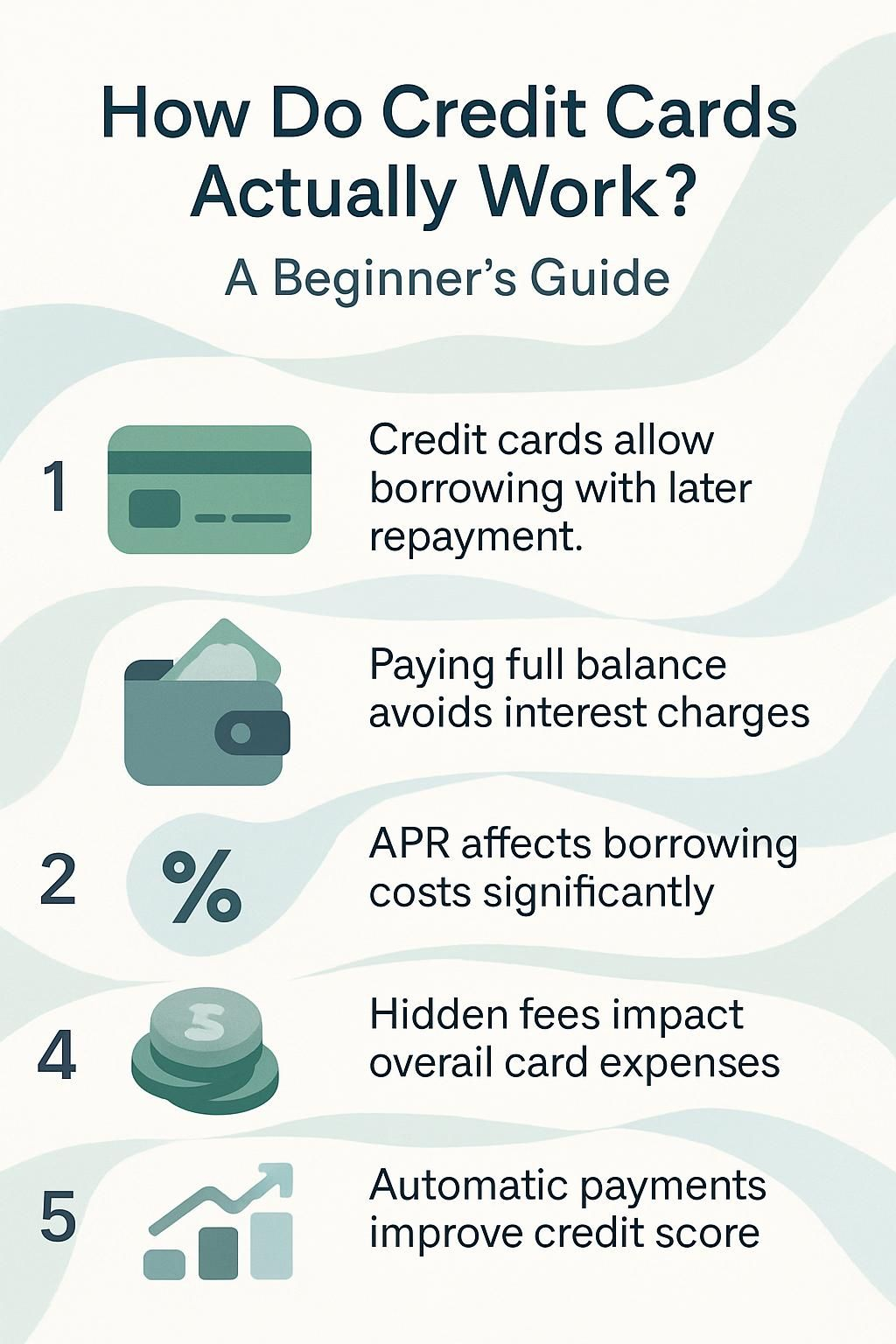

Key Takeaways

- Credit cards offer a line of credit from banks, allowing purchases now with repayment later, affecting your credit score based on how you manage payments and balances. Responsible use includes paying the full balance by the due date to avoid interest and maintaining low credit utilization.

- Various types of credit cards cater to different financial needs and spending habits, including rewards cards that provide cash back or travel points, secured cards for building or repairing credit, and balance transfer cards designed to consolidate debt at lower interest rates.

- Key terms necessary for understanding and managing a credit card include APR (Annual Percentage Rate), which influences the cost of borrowing money; grace period, providing a window to pay off balances without incurring interest; and the credit limit, setting the maximum amount you can spend.

- Hidden costs such as annual fees, cash advance fees, balance transfer fees, penalty APRs for late payments, and foreign transaction fees can add up. Monitoring statements for errors or unauthorized charges helps maintain account integrity.

- Automatic payments ensure timely bill settlement improving payment history—a crucial factor for a good credit score. Regularly reviewing account terms like minimum payment requirements and fee structures supports responsible management while maximizing benefits like reward programs or lower interest rates on future loans.

What is a credit card and how does it work?

A credit card acts as a line of credit issued by major banks or financial institutions, letting you make purchases now and pay later. Each swipe borrows money up to your approved credit limit from your card provider.

Payments made with the card do not immediately leave your checking account like with debit cards. Instead, the bank covers costs for transactions such as booking luxury travel or buying rare art online.

You repay these expenses at the end of each billing cycle through monthly statements.

Card payments can boost your credit score if managed wisely, since payment history and debt levels affect reports monitored by Experian, Equifax, and TransUnion. You might unlock extra perks like cash back rewards programs or premium lounge access when using certain cards.

If you carry a balance past the due date, interest rates kick in based on each card’s annual percentage rate (APR). “A well-managed card often becomes an essential tool for maintaining both convenience and strong financial health,” notes CNBC Select finance editor Alexandria White.

The next section reveals how borrowing funds works along with minimum payments and interest charges in more detail.

How credit cards operate

Credit card companies lend you money with a set credit limit for your purchases. You can make payments later, but interest rates and fees apply if you don’t pay the full balance by the payment due date.

How do I borrow funds up to my credit limit?

To borrow money up to your credit limit, swipe your card at retailers or enter the numbers online. Each purchase subtracts from your available credit. Your card company authorizes these transactions until you reach that set ceiling called a credit line.

You can also get cash advances using an ATM, though this usually comes with extra fees and higher interest rates than standard purchases. Many people overlook how quickly spending on luxury items or travel can build up a balance quite close to their maximum limit.

A friend once used his secured credit card for a major renovation project. He checked his statement after each transaction to track his remaining available credit and avoid going over his cap, which would have led to penalty APR charges and possible impact on his credit score.

Always watch both your outstanding balance and current limit; if you cross it, the issuer might decline further purchases or even hit you with expensive fees. This approach helps maintain strong financial health while making the most of consumer credit tools like cash back rewards cards or personal loans offered by banks.

What are minimum payments and how do interest rates apply?

Credit card companies set a minimum payment, which is the smallest amount you must pay each month to keep your account in good standing. This minimum payment usually equals a small percentage of the credit card balance plus interest and any fees from late or over-limit charges.

Paying only this amount lets you avoid penalties but leaves most of your balance unpaid, so credit card interest starts compounding daily on what remains.

Interest rates, also called APR (Annual Percentage Rate), quickly increase how much you owe if you do not pay off your statement balance in full by the due date. For example, if your APR is 20 percent and you leave $10,000 unpaid, that debt will grow more expensive each day.

“Carrying a high-interest balance inflates costs long after luxury purchases lose their shine.” High balances can reduce financial health and can harm your credit score over time because they push up your debt-to-income ratio.

What is a credit card billing cycle?

A credit card billing cycle usually lasts between 28 and 31 days. During this time, your credit card company tracks each purchase, cash advance, and payment you make. At the end of the billing cycle, your issuer sends a statement that lists every transaction, fees such as annual or balance transfer fees if any applied, plus interest charges when there is an unpaid balance.

Your available credit updates at the end of each billing period to reflect new payments and purchases.

Efficient expense tracking helps you spot errors or unauthorized charges on your statement before paying. I always review my statements right after each cycle ends to catch anything unusual; once I found a subscription fee doubled by mistake and contacted customer service for an immediate reversal.

Understanding how the billing cycle works can help you manage minimum payments and avoid late fees or unnecessary interest charges. Knowing these basics sets you up for choosing the right rewards cards next.

Types of credit cards

Credit cards come in different forms based on your spending habits and financial plans, so you can find options that fit how you like to borrow or earn rewards—keep reading to see which one matches your lifestyle best.

What are rewards credit cards?

Rewards credit cards let you earn points, miles, or cash back on everyday purchases. Cardholders receive incentives for spending in specific categories like dining, travel, and groceries.

For example, some offer 2% cashback rewards at supermarkets while others provide airline miles or hotel loyalty points with each dollar spent. Top issuers like Chase, American Express, and Capital One structure reward rates based on purchase types to maximize your return.

You can redeem these benefits as statement credits, gift cards, luxury travel bookings through provider portals or even direct deposits into a savings account. Many premium options include sizable sign-up bonuses if you meet minimum spend amounts within the first few months.

These features make rewards credit cards attractive for high spenders who want perks from their existing expenses—with annual fees often justified by exclusive access to airport lounges and VIP event invitations.

What are secured credit cards?

After exploring credit card rewards, it helps to understand secured credit cards. These cards offer a way to build or strengthen your credit score by requiring a refundable security deposit as collateral.

You pay this deposit up front, which usually determines your available credit limit. For example, depositing $1,000 gives you an equal $1,000 limit.

Credit card issuers report your payment history to credit bureaus just like with regular unsecured cards. Making timely payments can improve your credit report and increase financial options in the future.

Secured credit cards often have annual fees and higher interest rates than standard cards but provide access if you lack established credit history or want a fresh start after financial setbacks.

What are balance transfer credit cards?

Balance transfer credit cards let you move your existing credit card balance to a new account with a lower interest rate or even a 0% introductory APR. Many banks like Chase and Citi offer these cards as tools for people who want to consolidate their debt.

A balance transfer can help reduce the amount of interest paid on large balances, especially if you pay off the transferred amount during the intro period. Some issuers may charge a balance transfer fee, which is usually around 3% to 5% of the total moved.

Save money by shifting high-interest debt to a lower-rate card.

This strategy helps streamline payments while potentially boosting your credit score by lowering credit utilization on old cards. Watch out for new purchase APRs and make sure payments stay on time since any missed payment could mean losing that promotional rate.

Next up: learn key terms like APR, grace periods, and what counts as your full statement balance each month.

Key credit card terms to understand

To use credit cards wisely, you need to know a few basic terms. Understanding things like APR, grace period, and your card’s limit can help manage payments and avoid debt.

What is APR (Annual Percentage Rate)?

APR, or Annual Percentage Rate, shows the yearly cost to borrow money on your credit card. Credit card companies set APR as a percentage, including both interest rates and some fees.

If you carry a balance beyond the grace period, the APR determines how much interest adds up each month. For example, if your purchase APR is 20 percent and you owe $10,000 for a year without payments, you will pay about $2,000 in interest.

Different transactions can have different types of APRs. You might see higher rates for cash advances or late payments. Your credit score affects which rate you get from your credit card issuer.

High scores usually unlock lower APRs. Reviewing your annual percentage rate helps protect against high costs and supports better credit card management decisions while growing your finances with responsible usage.

What does credit limit mean?

Interest rates set the stage for how much borrowing a credit card may cost you, but your credit limit puts boundaries on how much you can actually spend. Each credit card issuer assigns you a maximum amount that you can borrow at any one time; this is called your credit limit.

For example, if your available credit is $25,000, then any purchases or cash advances must not exceed that total.

Your payment history and overall credit score play major roles in determining this figure. If you keep your balance below 30% of this limit, for example under $7,500 on a $25,000 line, it often helps improve or protect a strong credit score according to Experian and TransUnion reports from 2023.

Based on my experience with high-limit cards like those offered by American Express and Chase Private Client, higher limits bring more spending power but also require greater discipline to avoid unnecessary fees or negative marks on your statement balance.

What is a grace period?

A grace period refers to the window of time after your credit card billing cycle ends and before your payment due date. During this time, you can pay off the full statement balance without paying interest on purchases.

Most major banks or credit card providers offer a grace period of at least 21 days, but always review your terms and conditions for details.

Paying your entire balance within this window helps you avoid costly interest charges, which can add up quickly even with high available credit or elite cards. Missing the grace period means that interest will apply to new purchases and sometimes also retroactively from the purchase date.

Using automatic payments ensures you never miss this valuable benefit and helps keep your financial health strong while managing credit card debt responsibly.

Tips for using credit cards responsibly

Smart credit card management keeps your financial health strong. Use automatic payments and expense tracking tools to help prevent missed payment due dates and spot unauthorized charges fast.

How can I pay balances in full and on time?

Set automatic payments with your credit card issuer using your checking account. This step ensures you never miss a payment due date and helps maintain excellent payment history for your credit score.

Schedule the payment a few days before the end of your billing cycle to cover any last-minute transactions, avoiding interest charges or late fees. If you prefer manual control, set calendar reminders just after receiving each statement balance.

Monitor statements closely for errors and unauthorized charges each month. Pay the full statement balance instead of only making minimum payments to prevent costly interest rates from compounding on leftover debt.

Using digital expense tracking tools has helped me stay on top of spending and guarantees enough available credit every month. Building this habit helps keep finances healthy and also boosts credit card management success over time.

By understanding these habits, you can explore why maintaining low credit utilization is crucial next.

Why should I keep my credit utilization low?

Keeping your credit utilization low helps maintain a strong credit score and shows lenders you manage debt well. Credit bureaus calculate utilization by comparing your current balance to your total available credit.

For example, using only $5,000 of a $50,000 limit keeps usage at 10 percent—well below the recommended maximum of 30 percent. High balances can signal risk to banks and may cause interest rates on future mortgages or auto loans to rise.

Low credit card balances also give you more flexibility in financial emergencies. “Credit scores reward borrowers who use less of their available credit,” explains FICO analyst Ethan Dornhelm.

By staying aware of how much you borrow compared to your total limit, you help protect both your payment history and long-term financial health.

How do I monitor statements for errors?

After keeping your credit utilization low, focus attention on tracking every transaction in your monthly credit card statements. Scan through each line for unauthorized charges or purchases you did not make.

Compare receipts from personal expenses and trips with the statement balance to catch mistakes fast.

Use mobile banking apps or online account management tools offered by most card issuers. These services can alert you about unusual activity and help you flag any errors quickly. If a charge appears out of place, contact your card issuer right away to dispute it before interest rates or late fees are applied.

Regular reviews protect both your available credit and financial health while building trust in responsible credit card usage.

What are the hidden costs of credit cards and how can I avoid them?

Many credit cards carry hidden costs that can drain funds quickly, even for those with strong financial footing. Annual fees may be charged simply for using certain premium or rewards cards, while cash advance fees often run between 3% and 5% of each transaction.

Balance transfer fees usually fall around 3% to 5%, reducing the benefit of moving debt from one account to another. Interest rates can spike if you miss a payment, leading to penalty APRs as high as 29.99%.

Foreign transaction charges add up during travel and are typically about 1% to 3% per purchase made outside the U.S.

Careful management helps limit these expenses. Pay your statement balance in full every month to avoid interest charges tied to purchase APRs. Check the card’s fine print before agreeing to annual or balance transfer fees; some issuers waive these charges based on your spending level or relationship with their bank.

Consider using secured credit cards only when building credit history is essential since they often come with fewer perks and more upfront costs compared with unsecured options. Set up automatic payments so you never miss a due date or trigger late penalties that impact your credit score.

Understanding key terms like grace period, transaction fee schedules, and minimum payment requirements supports effective credit card management without added expense risk. Now take a closer look at tips for responsible use that help protect both wealth and your long-term financial standing.

Conclusion

Credit cards give you flexibility and convenience if you use them wisely. You can build a positive credit history, improve your rating, and make secure purchases. Paying on time protects your score and helps avoid interest charges or costly penalty rates.

Understanding basics like billing cycles, fees, and annual percentage rate keeps you in control of your financial health. Keep an eye on statements to prevent errors or unauthorized activity with each transaction.

For more detailed strategies on avoiding the pitfalls, check out our guide on understanding and avoiding hidden credit card costs.

FAQs

1. What is a credit card and how does it work?

A credit card allows you to borrow money from a credit card issuer up to a set limit in order to make purchases or get cash advances. The available credit decreases with each transaction, including purchase APR, cash advance APR, balance transfer APR fees.

2. How do interest rates and the annual percentage rate (APR) affect my credit card payments?

Interest rates are part of your annual percentage rate (APR), which determines how much you’ll pay for borrowing money on your credit card. If you don’t pay off your statement balance within the grace period, the issuer will charge interest on your remaining balance.

3. How does responsible usage of my credit card impact my financial health?

Responsible usage involves staying below your credit limit and making at least the minimum payment by the due date every billing cycle. This can build a positive payment history and improve your debt-to-income ratio, positively impacting both your financial health and building your credit score.

4. Can unauthorized charges affect my statement balance?

Yes! Unauthorized charges add to your total statement balance which may lead to an overdrawn account if not addressed promptly with the Credit Card Issuer.

5. What are some common fees associated with using a credit card?

Credit cards often have various fees such as annual fees, transaction fees like cash advance fees or balance transfer fees; also penalty APR might apply if payments are late or missed altogether.

6.How do secured and unsecured Credit Cards differ?

Secured cards require collateral like home equity loans while Unsecured ones don’t but typically require good-to-excellent-credit histories length that’s reported by three major bureaus.

Previous Post

Previous Post Next Post

Next Post