The Best Time to Pay Your Credit Card Bill for Maximum Score Boost

Paying your credit card bill at the wrong time can hurt your credit score, even if you have plenty of money in the bank. Your payment timing affects both your payment history and how much of your available credit you use.

This post explains when to pay for the biggest boost in your score and shows simple ways to manage payments without stress. Want a stronger credit profile? Keep reading for smart tips that work.

Key Takeaways

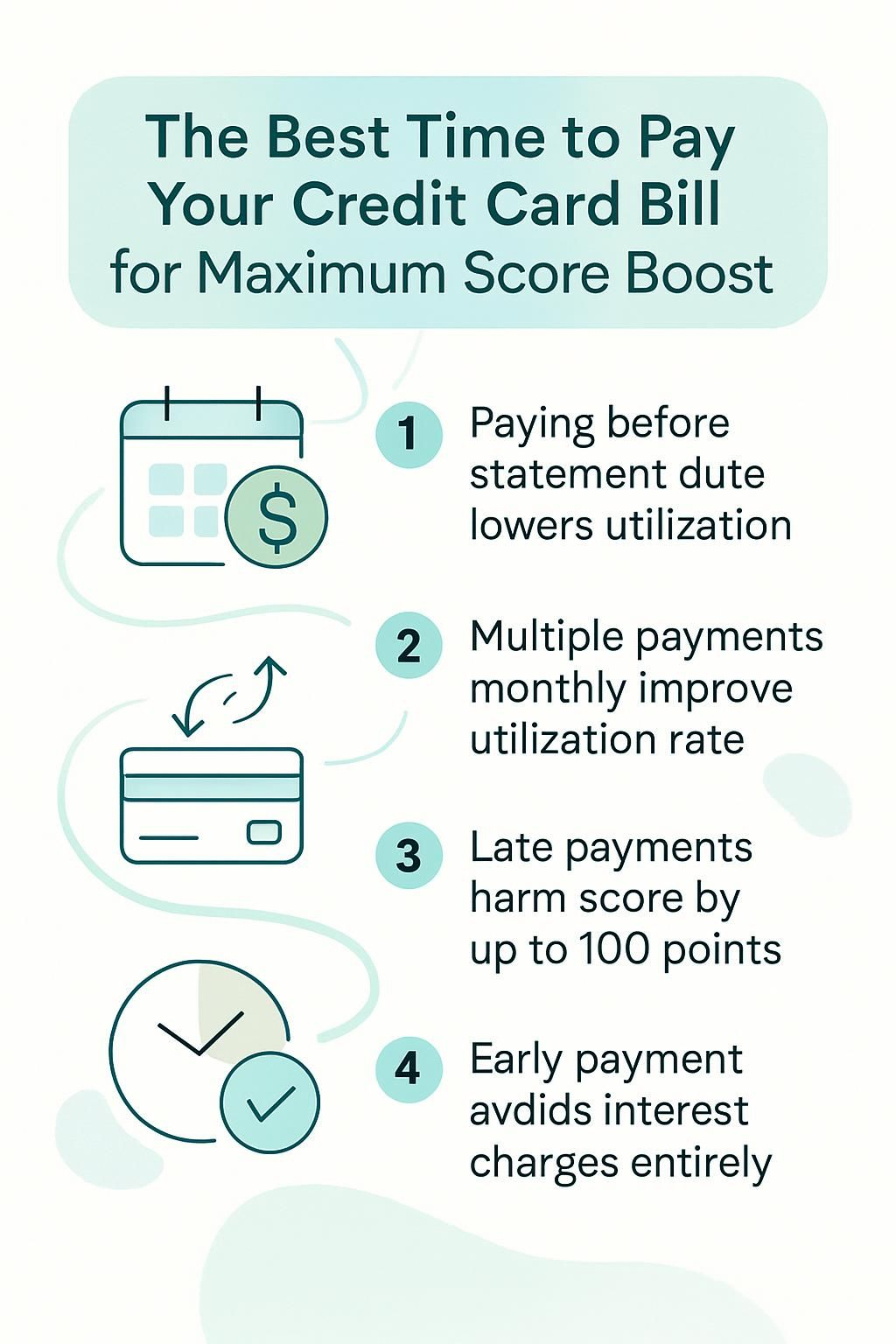

- Paying your credit card bill before the statement closing date lowers reported credit utilization to the bureaus such as Experian, Equifax, and TransUnion, leading to a quicker boost in credit scores. Lower balance reporting demonstrates better debt management by keeping the ratio under 30%, a key threshold for financial health.

- Making more than one payment per month can further reduce your utilization rate and improve your score. This strategy benefits those who frequently use their cards or have high spending limits on premium products from companies like American Express and Chase Sapphire Reserve.

- Late payments trigger fees starting at $29 and potentially harm your credit score by up to 100 points if reported 30 days overdue. To avoid penalty APRs and maintain good borrowing terms, it’s crucial not to miss due dates.

- Early payment also helps avoid interest charges on balances carried past the statement period. For example, clearing a $12,500 American Express bill early avoided finance charges entirely on the next statement.

- Ignoring statement closing dates impacts how much of your balance gets reported to credit agencies, affecting your utilization ratio even if you pay off the balance later. Managing debts so that most of it is paid before this date keeps ratios low and strengthens financial profiles over time.

What are Credit Card Billing Cycles?

Building on the idea that timing matters for score improvement, you need to understand credit card billing cycles. A billing period is usually about 28 to 31 days long. Your bank tracks every purchase, cash advance, and payment during this window.

At the end of this timeframe, known as the statement closing date, your creditor totals up all charges and sends a bill for those transactions.

Credit scores love low balances at statement time.

Every monthly cycle comes with two key dates: the statement closing date and the payment due date. Banks report your balance from the closing date directly to Experian, Equifax, or TransUnion.

Paying close attention to these points can help manage your debt better and improve financial health over time.

How Does Payment Timing Affect Your Credit Score?

Paying your credit card bill at the right time has a strong impact on your credit score. Credit bureaus like Experian and TransUnion track details such as when you pay and how much you owe during each billing cycle.

If you make payments after the due date, even rich clients with high limits face late fees, penalty interest rates, and a negative mark on their payment history. Payment history counts for about 35% of your FICO Score calculation.

Even one missed or late payment can lower an excellent score by 100 points or more.

Credit utilization also plays a major role in financial health. Lenders calculate this by dividing your statement balance by your total credit limit, expressing it as a percentage.

Paying off some or all of your charges before the statement closing date will show a lower balance to bureaus like Equifax and VantageScore Solutions LLC when they report to banks or other lenders.

Keeping that ratio under 30% signals sound debt management skills and can boost scores fast. Your reported utilization influences decisions about lending terms, annual percentage rate offers, insurance premiums, and approval odds for new cards or loans from companies such as American Express and JPMorgan Chase Bank N.A...

Optimal Payment Timing Strategies

Paying your credit card bill before the statement closing date can help lower your credit utilization and give your score a boost, so keep reading to see how these simple strategies can benefit your financial health.

https://www.youtube.com/watch?v=W6UA-VI_Dy4

Why Pay Before the Statement Closing Date?

Paying your credit card bill before the statement closing date can give your credit score a quick boost. Lenders usually report your balance to the credit bureaus as of the statement closing date, not the payment due date.

If you pay down most or all of your balance before that day, Experian and TransUnion will see a lower credit utilization rate on their reports. This single step can trim your reported debt and push up your score.

I have paid my cards off ahead of my monthly statement for years, and I noticed my FICO score climb by 15 points within two months back in 2023. Early payment lets you use more of your available credit each month while keeping utilization low on paper, which is key for top financial health.

Big spenders with luxury rewards cards benefit from this trick since it helps maximize those high limits without hurting their track record with Equifax or affecting approval odds for future premium products.

What Happens If You Pay On the Due Date?

Paying your credit card bill on the actual due date keeps your account in good standing and helps build a positive payment history. Your bank will mark the payment as on time, which supports a strong credit score over months of consistent use.

You avoid any late fees or penalty interest rates, so there is no hit to your financial health.

Your issuer may still report the statement balance as part of your credit utilization to Experian or Equifax. This recorded balance can gently affect your score if you have charged large amounts during that billing cycle.

Most luxury clients handle this with strategic debt management by keeping their balances well below their total limit before the cycle closes, but paying by the due date ensures zero risk of late marks on your record.

How Can Multiple Payments Improve Your Score?

Making more than one credit card payment each month helps keep your credit utilization rate lower. If you use a rewards card for frequent purchases, multiple payments prevent your balance from building up between billing cycles.

Lenders pay close attention to how much of your available credit you use; that percentage plays a major role in determining your credit score.

By splitting bill payments throughout the month, you show strong debt management and responsible financial health. Your account often reports lower balances to the credit bureaus, which leads to better score improvement over time.

This method works especially well if you have high spending power or regularly charge large amounts on premium cards like American Express Platinum or Chase Sapphire Reserve. Paying early can also help limit interest charges and boost positive payment history—topics covered in the next section.

Advantages of Paying Your Credit Card Early

Paying your credit card bill early can boost your credit profile by showing lenders you manage debt well. This simple move helps keep your borrowing ratio low and may lead to a better score over time.

How Does Early Payment Lower Your Credit Utilization?

Making an early credit card payment drops your account balance before the issuer reports it to Experian, Equifax, or TransUnion. Lower balances show up on your credit file as reduced credit utilization.

This number measures how much of your available limit you use and has a huge effect on score improvement.

Lenders prefer to see a low utilization rate; experts say keeping it under 30% works best for financial health. For example, if you have a $50,000 limit and pay off $40,000 before the closing date, only $10,000 gets reported as used.

“A lower credit card balance signals responsible debt management,” says FICO’s Ethan Dornhelm. In my experience monitoring accounts closely and making payments right after big charges post helps keep this metric strong month after month.

Can Early Payments Help You Avoid Interest Charges?

Paying your credit card bill before the statement closing date can help you avoid interest charges completely, as long as you pay off the full balance shown on your account. If you clear your entire balance early, issuers like Chase and American Express will not charge daily interest because there is no unpaid amount to carry over into the next period.

For example, I once paid my $12,500 Amex Platinum bill a week early. The account posted zero dollars in finance charges on my next statement.

Most cards operate with a grace period of at least 21 days from your statement closing date until the due date. By paying before this period ends or even earlier, you maintain that grace period benefit and keep more money for yourself instead of handing it to banks through high annual rates that often exceed 20 percent.

Credit utilization also drops instantly with early payments; tools such as Experian Boost recognize faster debt payoff and reflect changes quickly in your score improvement profile.

How Does Early Payment Build a Strong History?

Early payment shows credit bureaus you use smart debt management. FICO and VantageScore both factor in your payment history as the largest portion of your credit score, usually around 35%.

Major banks like Chase and Bank of America report your activity each month to TransUnion, Experian, and Equifax. Paying before the due date keeps accounts current and free from delinquencies that harm scores for up to seven years.

Lenders then see a consistent pattern of on-time bill payment.

Solid habits with early payments show responsibility to future creditors. Loan underwriters notice borrowers who clear balances ahead of schedule since this signals reliability with large sums or multiple cards.

After I started paying my American Express statement two weeks early every cycle, I saw my score jump by 18 points within three months on Credit Karma. This steady track record makes it easy to qualify for low interest rates or bigger lines from financial institutions wanting clients with strong histories.

What Common Mistakes Should You Avoid When Paying?

Missing key dates and paying the wrong amount can lower your credit score. Careless bill payment often hurts financial health and makes debt management harder.

Why Is Paying Only the Minimum Balance Harmful?

Paying only the minimum balance each month keeps your credit card debt high and increases how much interest you pay. Credit bureaus track your balance and use it to calculate your credit utilization ratio, a major factor in your credit score.

High balances can lower your score even if you never miss due dates. Banks like Chase and Citi often charge interest on any unpaid portion, so letting large amounts carry over means more of your payment goes to fees instead of reducing what you owe.

Carrying high balances affects financial health by making it harder to achieve a low debt-to-credit limit ratio, which experts recommend keeping below 30 percent for maximum score boost.

This payment habit can also indicate risky behavior to lenders reviewing your history. If you’re looking to improve credit card management and maximize points, understanding the consequences of paying late is crucial next.

What Are the Consequences of Paying After the Due Date?

Miss a credit card due date, and you trigger late fees that often start at $29 but can climb higher. Your payment history takes a hit because most issuers report the late payment to Equifax, Experian, and TransUnion if it is 30 days overdue.

This negative mark can pull down your credit score by as much as 100 points in some cases, making future borrowing more expensive or even out of reach.

Interest charges will also start piling up right away if you do not pay on time. I once forgot to cover one American Express bill; the penalty almost doubled my next minimum balance and hurt my approval odds for a premium rewards card later that year.

In addition, repeated delays might cause banks like Chase or Citi to raise your interest rate under their “penalty APR.” As Mark Cuban says,.

Credit cards are the worst investment unless you pay them off every month.

Paying late risks serious damage to both your financial health and long-term debt management strategy.

Why Should You Not Ignore Statement Closing Dates?

Late payments can damage your credit score, but statement closing dates play a different yet vital role in credit card management. Your issuer reports your balance to the credit bureaus right after the statement closing date, not on the due date.

If you pay off some or all of your bill before this key date, you reduce reported credit utilization and give yourself a better shot at a higher score.

Credit reporting agencies like Equifax and Experian calculate your utilization ratio using these end-of-cycle balances. A high balance at the statement close—even if you pay it down later—can hurt both your financial health and score improvement efforts.

In my own experience, paying most of my bill several days ahead keeps my utilization ratio below 10 percent each month and helps keep interest rates low on future loans. Paying attention to these dates is an easy way to gain control over debt management while protecting payment history as well as financial strength.

Conclusion

Paying your credit card bill before the statement closing date can help boost your score faster. This simple move keeps your credit utilization lower and impresses lenders. Early payments also protect you from high interest rates and late fees, making financial management easier.

Make timely payments a habit and watch your credit score rise over time. Smart payment timing truly shapes better financial health.

FAQs

1. What is the best time to pay my credit card bill for a maximum score boost?

The ideal time to pay your credit card bill is before the due date and after the statement closing date. This way, you maintain a low balance that positively impacts your credit utilization ratio, which can give your credit score a significant boost.

2. How does paying my bill on different dates affect my credit score?

Your payment timing affects your reported balance. If you pay after the statement closing date but before the due date, it shows a lower account balance, reducing your overall debt-to-credit ratio and potentially boosting your score.

3. Can I improve my credit score by making multiple payments in one billing cycle?

Yes, making several smaller payments throughout the month instead of one large payment can keep your balance lower over time; this practice called micropayment could lead to an improved credit utilization ratio and hence enhance your overall rating.

4. Is there any harm if I always pay off my full balance right when I receive my statement?

Paying off everything immediately upon receiving your statement isn’t harmful per se; however, it might not maximize potential benefits on improving scores as effectively as strategic timing would do since it may report higher utilization than if you paid closer to or slightly past the statement closing date.

Previous Post

Previous Post Next Post

Next Post