Virtual Credit Cards: The Future of Secure Payments?

Worried about your credit card details getting stolen during online shopping? Virtual credit cards use single-use numbers to help protect your private information. This post will show how these digital payment tools keep your transactions safe and make spending easier, from fraud prevention to better control over payments.

See if virtual cards are the future of secure payments.

Key Takeaways

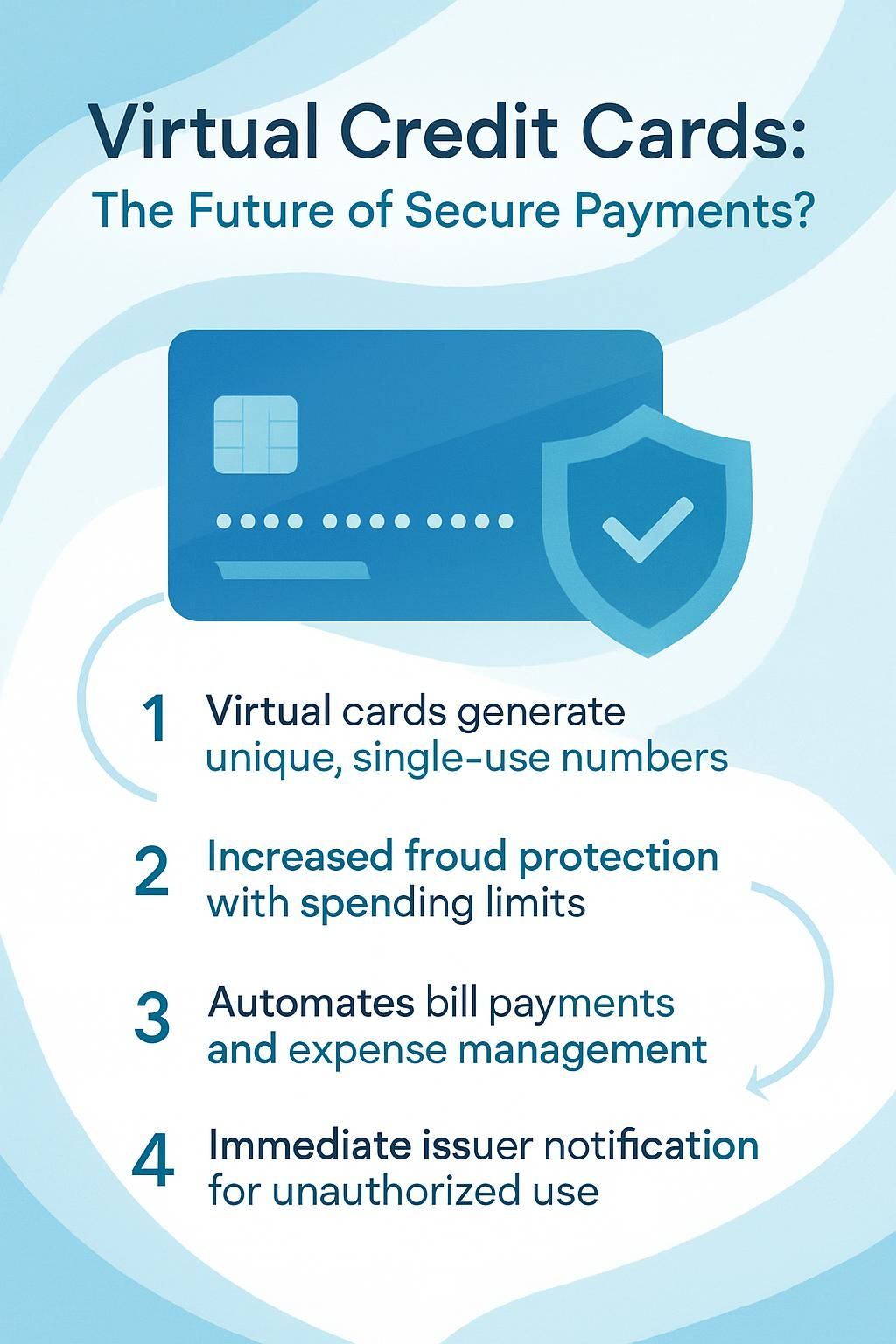

- Virtual credit cards generate unique, single-use numbers for each transaction, enhancing online security by keeping real card details hidden from retailers and hackers. Companies like Mastercard and Visa provide these services through banks and fintech apps.

- The benefits of using virtual credit cards include increased protection against fraud with features such as customizable spending limits and automatic expiration dates. This makes them ideal for managing subscriptions, online shopping, luxury purchases, B2B payments on platforms like Stripe, and streamlining reconciliation tasks for businesses.

- Businesses leverage virtual cards to automate bill payments and improve expense management by integrating them into accounts payable systems. These tools offer detailed reporting on expenses, facilitate vendor payments securely, and ensure compliance with budgeting controls across departments.

- In the face of a compromise or unauthorized use of a virtual credit card’s details, immediate actions include notifying the issuer for blocking further transactions, updating security settings (passwords), monitoring account activity closely for any irregularities, and considering additional protective measures like credit report monitoring.

- Choosing the right virtual card provider is crucial for maintaining financial security; it involves looking at factors such as advanced encryption standards for online security, integration capabilities with accounting software for ease in managing expenses both personally and professionally, transparent fee structures to avoid hidden costs in transactions made using digital payment options.

What are virtual credit cards?

Transitioning from the growing need for secure digital payment methods, virtual credit cards have started to redefine the way people handle online transactions. These digital payment tools generate unique card numbers, expiration dates, and security codes that work solely online or with mobile wallets.

Companies like Mastercard and Visa offer these solutions through banks and fintech apps such as Capital One Eno or Citi Virtual Account Numbers. A single-use number can be assigned for each transaction; this limits exposure in the event of a data breach.

Every virtual card allows users to set their own spending limits, making them ideal for luxury ecommerce purchases, subscription management services like Netflix or Amazon Prime, or even B2B payments on platforms such as Stripe.

If compromised during an online purchase at high-end retailers like Neiman Marcus or Saks Fifth Avenue, a virtual card becomes useless after that one use or once its custom expiration date passes.

Businesses leverage them to streamline reconciliation tasks while giving financial teams tighter control over outgoing expenses.

Virtual cards make your money harder to steal by generating new numbers every time you pay.

How do virtual credit cards work?

Virtual credit cards create a unique, single-use number for every transaction. This digital payments tool connects directly to your main credit account but shields your real card details.

Mastercard and Visa both offer these services through fintech apps or major banks. For each purchase, the system generates new expiration dates and security codes which locks out hackers from accessing long-term information.

Users can set strict spending limits per virtual card or arrange automatic expiration after one use. If someone steals the virtual card number during an ecommerce purchase, you can immediately deactivate it without risking your actual account balance or history.

Digital wallets often house multiple virtual cards for specific online transactions and subscription management. These processes give wealthy shoppers tight control over payment processing while boosting transaction security in today’s digital age.

Look next at how these benefits make life safer and easier for users enjoying luxury goods or managing high-value expenses.

Benefits of virtual credit cards

Virtual credit cards boost your payment security with digital wallets and strong cybersecurity, making online transactions faster and safer—keep reading to explore more ways they can upgrade your everyday spending.

How do virtual credit cards enhance security with unique details?

Banks and fintech firms like Capital One and Stripe issue virtual credit cards with single-use numbers for each payment. These digital cards feature their own expiration dates and security codes, so your actual card details remain hidden from retailers or hackers.

You can set unique spending limits per card, which helps prevent large unauthorized transactions.

If cybercriminals gain access to a temporary number, it simply expires after the transaction or set end date, stopping further fraud attempts. Used in ecommerce payments and subscription services, this strategy provides an extra layer of online security while boosting identity protection.

With more than 75 percent of businesses adopting these secure solutions by 2024 according to Juniper Research, financial technology now puts you one step ahead in transaction safety and fraud prevention.

How can spending limits and expiration dates improve control?

Setting spending limits on each virtual credit card adds a strong layer of transaction control and risk mitigation. You can cap the amount charged per card, which instantly prevents unauthorized or excessive transactions—a powerful tool for online security and digital wallets.

For businesses, this feature simplifies corporate spending management by allowing owners to keep close tabs on employee expenses.

Expiration dates further strengthen account management. Each virtual card may be set to expire after one purchase or within a specific period, meaning compromised numbers become useless—protecting your main account details from ongoing fraud.

Using payment automation tools like American Express Go and Marqeta lets you automate expense tracking with detailed reporting and easy reconciliation. “A single-use expiration date stopped a scammer cold,” as my assistant once told me after halting an attempted breach in 2022 using these features.

Let’s look at how people use virtual cards for online shopping and subscriptions next.

Use cases for virtual credit cards

Virtual credit cards make digital payments safer and more private for both personal shopping and business expenses, so explore how they fit into your daily online transactions.

How are virtual cards used for online shopping and subscriptions?

Virtual cards reform the way we transact online and manage subscriptions, presenting unparalleled security and regulation. They produce unique numbers for each transaction, safeguarding our primary account details.

- Internet shoppers utilize virtual cards to acquire goods without revealing their real card number. This procedure significantly reduces fraud likelihood.

- Individuals establish virtual cards with one-time usage limits for test subscriptions, prohibiting charges past the trial period.

- Virtual cards permit users to designate precise spending caps, guaranteeing they remain within budget during internet shopping sessions.

- Subscription services become more controllable with distinctive virtual cards, simplifying termination procedures and circumventing unwanted renewals.

- Buyers frequently assign termination dates that coincide with subscription periods or anticipated purchase dates, offering an extra layer of transaction regulation.

- Commercial professionals utilize virtual cards to smooth online payments for software subscriptions and cloud services, improving expense monitoring.

- Skilled users assimilate virtual cards into digital wallets for expedited checkout processes without entering card details manually.

- Financially aware individuals employ them for booking travel plans online, securing early bird rates or special offers while shielding their primary account data.

Each application underscores the usefulness of virtual cards in our digital age, showing a direct sense of convenience combined with potent security actions against unauthorized transactions and data breaches.

How do businesses use virtual cards for payments and expense management?

Transitioning from individual use in online shopping and subscriptions, businesses utilize the power of virtual cards for advanced payments and expense management systems. The digital age requires adaptable, secure payment methods for firms intent on streamlining procedures and improving security protocols.

Businesses utilize virtual cards to automate their bill payments, ensuring prompt settlements and evading delayed charges. These digital apparatus connect directly with the accounts payable systems, easing the payment procedure for repeated charges like software subscriptions or web services. Employees are given virtual cards with established spending limits, providing precise regulation over business expenses. This tactic inhibits overexpenditure and unauthorized transactions by setting definite thresholds on each card. Expense tracking becomes seamless as every transaction made with a virtual card tracks into financial software automatically. Instant updates and categorized spending reports aid in budget examination and predicting future costs. Vendor payments via virtual cards assure B2B transactions against fraud while ensuring immediate compensation for services provided. Merging with accounting platforms eases reconciliation processes, reducing manual entry mistakes and administrative workload. Firms assign specific virtual cards to particular projects or departments, enhancing transparency over expenditures and aiding in accurate cost distribution.

For a personal encounter, think of assigning virtual cards across different teams in your firm. You distribute funds specific to each team’s needs while retaining an extensive view of company finances through a single dashboard. This method not only enhances financial controls but also provides department heads with immediate supervision of their budgets.

In summary, businesses adopting virtual credit cards gain from improved security features, thorough expense tracking capabilities, automatic payment solutions, and improved operational efficiency in managing both internal resources and external vendor relations.

How do virtual cards help prevent fraud?

Virtual credit cards help block identity theft because they use unique, single-use numbers for each transaction. Digital wallets like Apple Pay or Google Pay store these temporary card details and make online purchases safer.

Hackers cannot access your main credit account since payment providers like Mastercard give every virtual card its own expiration date and security code. Setting spending limits on a virtual card stops thieves from running up charges if cybercriminals get the number.

Online merchants only see the temporary data, which protects your real financial info during ecommerce checkouts and subscription payments. If someone does steal a virtual card number, you can instantly deactivate it without affecting your main line of credit at JPMorgan Chase or American Express.

The growing popularity of secure transactions using encrypted digital tools shows that fraud prevention is now a top priority for wealthy clients in 2024 as financial institutions step up their monitoring to respond to new threats fast.

What should I do if my virtual credit card details are compromised?

Discovering your virtual credit card details have been compromised pushes you into action immediately. Swift, decisive steps are required to prevent further harm. Here’s an action guide:

Start by alerting your card issuer about the unauthorized charges. They are equipped with processes to manage such incidents.

Strengthen your account credentials. Update your passwords and security questions to augment safety.

Keep a close watch on your account for any irregular activity. Consistent checks can detect any more unauthorized transactions at an early stage.

Communicate with relevant authorities or organizations that focus on identity theft. They provide extensive resources and guidance throughout the recovery stage.

Think about using a credit report monitoring service. This step keeps you updated about any misuse of your identity.

Notify websites where the compromised card has been used about the breach. They can monitor for any suspicious activities linked to your account.

Request a new virtual credit card from your provider, thus ensuring seamless service while upholding security.

Adopt proactive measures by defining spending limits and expiration dates on new virtual cards, granting better management over future transactions.

These measures provide a strong defense against the negative effects of having your virtual credit card information stolen; they also recommend more stringent safeguards for personal financial information in the future. Now, we’ll examine how the choice of the right virtual card provider can significantly contribute to payment security and control.

How do I choose the right virtual card provider?

Losing control of your virtual card details can cause stress, so selecting the right provider helps reduce that risk from happening again. Wealthy individuals often want digital payment options that pair privacy protection with advanced financial technology.

Look for a provider offering top-tier online security, strong encryption standards, and customizable card features such as flexible spending limits or instant expiration after use.

Make sure the platform offers seamless integration options into common apps like QuickBooks or SAP Concur to boost efficiency for personal or business expenses. A solid user experience should include fast account setup and easy management of multiple cards in one dashboard.

Transparent transaction fees are critical; you do not want hidden charges eating into your funds over time. Responsive customer support will give peace of mind around the clock if issues come up during international travel or large purchases using your virtual payment cards.

Conclusion

Virtual credit cards continue to shape the future of secure payments. They give you peace of mind for online shopping and business-to-business transactions by using single-use numbers, spending limits, and custom expiration dates.

With growing digital wallets and financial technology tools, managing your money has never been easier or safer. As cybersecurity risks increase, tools like tokenization make each transaction smoother and more reliable.

Smart use of virtual cards helps keep your finances both secure and efficient in today’s digital world.

FAQs

1. What is a virtual credit card?

A virtual credit card is an online version of your physical credit card, created to make secure payments on the internet. It functions similarly to a traditional card but offers additional security features.

2. How does a virtual credit card enhance payment security?

Virtual cards add an extra layer of protection by generating unique numbers for each transaction, keeping your actual account details hidden. This makes it harder for fraudsters to access sensitive information, enhancing payment security.

3. Are virtual credit cards the future of secure payments?

Considering their increased use and robust safety measures, many experts believe that virtual credit cards could indeed represent the future of secure digital transactions.

4. Can I use my regular bank account with a virtual card?

Yes, you can link your regular bank account or even another credit card to your virtual one! The funds are still drawn from the same source; however, the transactions are processed in a more secure manner.

Previous Post

Previous Post Next Post

Next Post